The need to reclassify KYCs under various categories arose after it was found that KYCs of many investors were still not updated with PAN and Aadhar, and the linkages were missing.Several of these KYCs were done using documents like utility bills (electricity, telephone), bank account statements etc, which are no longer accepted as valid documents for KYC compliance by Sebi.

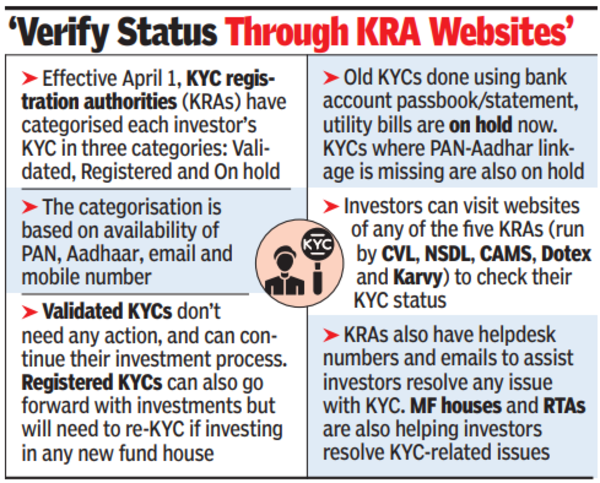

Effective April 1, under the updated KYC compliance process, KRAs have categorised each investor’s KYC in three categories: validated, registered and on hold. The categorisation was based on availability of PAN, Aadhaar, email and mobile number of the investors, an official from a KRA said.

Investors with validated KYCs don’t need to act and can continue their investment process. Those with registered KYCs can also continue their investments but will need to resort to the re-KYC process if they invest in any new fund house or open a new demat account.

KYCs that were done using bank statements, utility bills and other similar documents are on hold now and investors with these KYCs can’t invest anymore. They would also not be allowed to withdraw funds unless they update KYC documents.

Of nearly 11 crore investors, about 7.9 crore or 73% have valid KYC, a release from the KRAs said. KYCs of about 1.6 crore investors are under the registered category, who now have limited access to investing, while 12% of the total can’t operate their demat accounts and MF folios.

“Investors can verify their KYC status through any of the KRA websites under ‘KYC inquiry and initiate action,” the release said. Investors can also modify their KYCs through the websites of their brokers and MFs. And if the KYC is modified once, that will reflect on all their investments like stocks, MFs and commodities. Investors need not update their KYC with each broker and fund house they have accounts or folios with.