Sharing the incident in a long post on X, formerly Twitter, Aditi wrote how she narrowly escaped becoming a victim of this emerging financial scam that employs carefully crafted SMS messages to create confusion and ultimately steal money

Aditi recounted that she was engaged in an office call when an individual phoned her, claiming to need to transfer money to her father. Allegedly encountering issues with his own bank account, he requested Aditi’s assistance in receiving the funds. Shortly after the call, she received an SMS alert resembling typical bank notifications. The message indicated that the funds had been credited to her account.

The caller then informed Aditi that he had intended to send Rs 3,000 but mistakenly transferred Rs 30,000 instead. He proceeded to request Aditi to return the excess amount. However, upon examining the SMS alerts she had received, Aditi noticed discrepancies and realized that she was on the verge of falling victim to a financial scam.

Here’s the post Aditi has shared on X, aimed at creating awareness about this scam.

Read the complete post here

Another day, another financial fraud scheme 🥸

TLDR: Please read and make sure you don’t trust any SMSes regarding financial transactions.

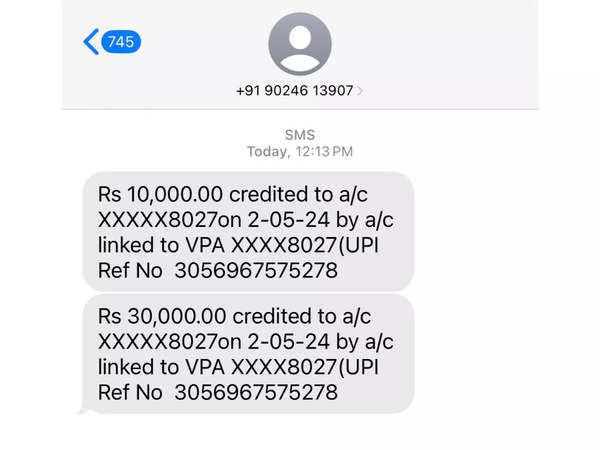

Incident: Was busy on an office call when this elderly sounding guy calls me and says, ‘Aditi beta, papa ko paise bhejne the par unko ja nahi rahe toh unhone bola aapko bhejdu. Beta check karo aapka number yahi hai na’. Said out my number aloud and immediately I see this SMS pop up in the exact same format as any bank credit SMS would look like.

I first received an SMS mentioning an INR 10k credit, then an INR 30k credit, all while he’s on the call. Then, he suddenly gets all worked up and is like, ‘beta, mujhe toh INR 3k hi bhejne the par galti se 30k bhej diye, pls aap baaki paise wapas bhejde mai doctor sahaab ke yaha khada hu, unko dena hai paise’.

The kind of urgency he was creating by crying out loud that he sent extra money, is at the doctor’s doorstep, sending UPI Ids to send the remaining amt back to etc. this is where I believe their real game lies. One could faulter and give in but Ik my dad, he over explains everything and triple checks in matters of money, whatever be the amount lol. He would have called beforehand and given me more context than needed 😝

And then the obvious, one look into the SMSes and you could see that they are from a 10 digit phone number, not a branded company ID.

Ofcourse when I called back in a minute’s time after checking my accounts, I was blocked.

TLDR; Always check your actual bank account on a separate device and never go by any SMSes. That system is very easily gameable.

Number I got the call from (also the UPI number he wanted money back on so there’s a bank account connected to it): 90246 13907.