“This day is the dawn of a new era,” he told the opening ceremony crowd, which had gathered to witness a row of Chinese trucks arriving to load cargo onto the first-ever container ship to pass through the port.

It was the official launch of the port’s operations nearly a decade after its completion. The ceremony also marked the start of the prestigious China-Pakistan Economic Corridor (CPEC), part of China’s global collection of infrastructure projects and trade networks known as the Belt and Road Initiative (BRI).

Yet today, nearly eight years later, this new era has yet to dawn. A DW analysis shows what went wrong.

‘Investors thought Gwadar would become Dubai’

The idea behind the CPEC was to connect China’s western Xinjiang province with the sea via Pakistan. This would shorten trade routes for China and help avoid the contentious Malacca Strait choke point, a narrow waterway between Malaysia and Sumatra that links the Indian and Pacific Oceans. Pakistan, meanwhile, would benefit from increases in trade, infrastructure and industry along the 2,000-kilometer corridor (1,240 miles), all financed by China.

In addition to the already established port of Karachi, Gwadar was chosen to connect the corridor to the global shipping network. The small fishing city lies near the Iranian border, some 500 kilometers away from Karachi.

Gwadar’s recently built deep-sea port, completed in 2007 and handed over to a Chinese operating company in 2013, was to become the heart of the CPEC. It would be integrated into a new special economic zone that would transform Gwardar into a bustling port city.

The port has potential, said Azeem Khalid, an assistant professor of international relations at COMSATS University Islamabad who studies Chinese investments in Pakistan. “It is a natural deep-sea port which can host bigger ships than Karachi. It sits at the crossroads of the global oil trade. And it would consolidate China’s regional interests,” he told DW.

At home, China has already proven it can transform sleepy fishing villages into economic powerhouses. Shenzhen, China’s first special economic zone, is the best example. In just four decades, the city’s population grew from around 60,000 inhabitants to more than 17 million today.

“Back then, investors thought Gwadar would become the next Dubai,” said Khalid.

China investing heavily in its Belt and Road network

Pakistan is not alone in pursuing this vision. All over the world, governments are hoping to boost their economies through new and expanded ports and other infrastructure projects — and Chinese banks are more than willing to provide financing. Chinese companies often build and operate the ports as well.

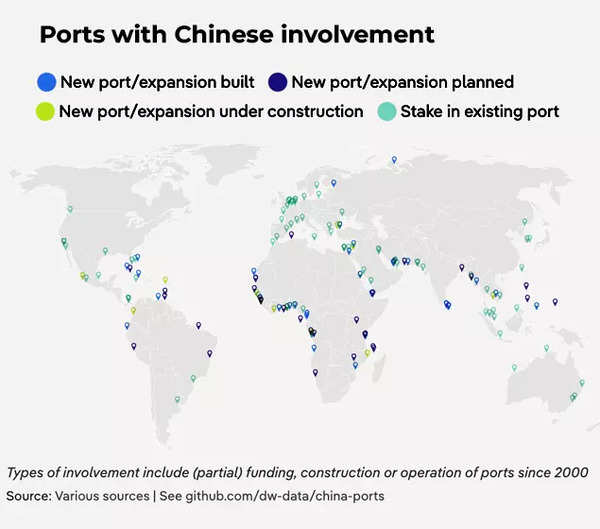

DW has collated information on at least 38 ports that have been built with Chinese investment since 2000; an additional 43 ports are planned or in construction. Seventy-eight existing ports also have Chinese stakeholders, DW found.

These deals are lucrative for China, said Jacob Mardell, a former analyst at the Mercator Institute for China Studies, a German think tank, and a journalist covering the BRI.

“This model almost kind of acts as a subsidy for Chinese companies,” he told DW. He explained that Chinese banks loan money to governments that then give that money to Chinese construction companies and pay the loan back to the bank over time. This means the money essentially never leaves China, “while the bill is ultimately footed by taxpayers in other countries.”

One common pattern appears to be building new ports relatively close to already established ones, as is the case with Gwadar and Karachi. The new ports are often meant to supplement or replace the older, less efficient ones over time.

This is also the case in Cameroon and Nigeria, for instance. In Cameroon, the newly built port of Kribi is set to replace the congested and far too shallow port of Douala, while in Nigeria, the port of Lagos is supplemented by the just-opened Lekki deep-sea port, less than 100 kilometers away. Both ports were financed and built by Chinese state-owned companies.

Similarly, in 2017, the government of Sri Lanka granted China a 99-year lease and majority stake in its relatively new Hambantota port, which was originally intended to supplement the country’s main port of Colombo.

Gwadar performs worse than other new ports

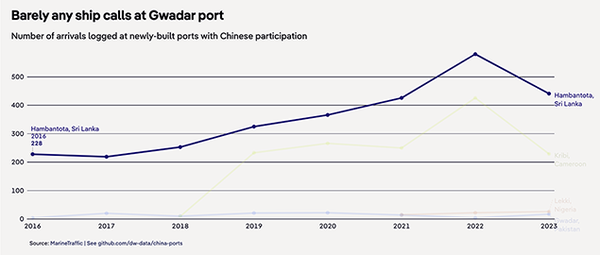

Lekki port received 26 ships in 2023, its first year of operation, according to ship tracking and maritime analytics provider MarineTraffic. It’s a modest number compared to bigger ports — but Gwadar, despite being completed in 2007, has only logged 22 ships in its best year to date. It has also failed to attract any regularly scheduled deep-sea shipping lines.

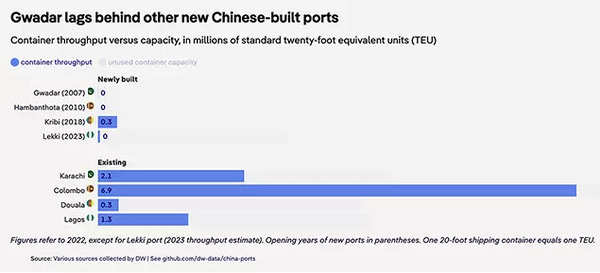

This means Gwadar processes almost no cargo that could generate income for Pakistan — or, for that matter, for the Chinese operating company. And it’s no wonder: Gwadar is operating at very limited capacity. The port’s three berths, where loading and unloading takes place, can handle 137,000 standard 20-foot shipping containers per year. In contrast, Karachi and its 33 berths can handle the equivalent of 4.2 million 20-foot containers per year.

While ports like Kribi or Lekki are comparatively small, they outshine Gwadar, the supposed new centerpiece of trade for South and Central Asia.

Khalid told DW that although Gwadar has the potential to eventually surpass Karachi, a lack of investment is holding it back. A $1.6 billion (€1.5 billion) expansion was promised in 2015, but little progress appears to have been made at the port since then. Much of the supporting infrastructure, including roads and railways needed to transport cargo to and from Gwadar, is also missing.

Publicly, investors like the China Pakistan Investment Corporation still claim Gwadar port is “becoming a focal point for trade and investment in the region.” But the empty port site suggests the opposite.

Mardell and Khalid said that behind the scenes, both Pakistan and China have become disillusioned with the project.

“Jobs promises were not met. Industrial promises were not met. The business opportunities for Pakistanis were not met,” said Khalid. “They [China] promised nine special economic zones. Not one is fully functional to date.”

CPEC hampered by political, economic instability

The of development in Gwadar broadly mirrors the situation in the rest of the China-Pakistan Economic Corridor. “CPEC has had problems since its inception,” said Mardell.

Some of these problems are specific to the border region of Balochistan, where Gwadar is situated. It is among the poorest regions of Pakistan and has strong separatist militias that commonly carry out attacks, including some that have specifically targeted Chinese nationals. In turn, the militias have been violently suppressed by the Pakistani military.

At the national level, Pakistan has been experiencing a severe economic crisis in recent years, and the country is still struggling to stabilize politically after the ousting of former Prime Minister Imran Khan in 2022.

“Since the political and security situation in Pakistan has deteriorated more recently, that’s hampered CPEC even more,” said Mardell.

China learning from its mistakes in Pakistan

On the Chinese side, Mardell thinks decision-makers might have miscalculated.

“When it comes to investment decisions, the Chinese are famously not risk-averse,” he told DW. He says “basically unlimited” state backing for state-owned investment and construction companies, coupled with the political will to rapidly step up competition with Western economies, has led China to fund even very risky projects in less stable countries worldwide.

“I just don’t think they fully understood the situation in Pakistan going in,” said Mardell, though he believes this might change for other projects going forward. “I think they’ve learned from their mistakes with the BRI and with CPEC, and they’re probably more reluctant to commit capital nowadays.”

In the last few years, and especially during the COVID-19 pandemic, China’s spending on BRI projects has slowed. But while the country may now be more selective in which projects it funds, it is starting to invest more again, with total BRI investment amounts having reached pre-pandemic levels.

Unsustainable investment pushes countries into debt

Still, countries like Pakistan are now stuck paying back large amounts of debt to Chinese lenders. “Pakistan has to pay billions of dollars back in loans, because of reckless investments in the name of CPEC,” said Khalid.

Similar cases have previously led to criticism that China is conducting debt-trap diplomacy, allowing partner countries to go into unsustainable amounts of debt to gain political influence.

Moreover, part of the revenue from the newly built projects also goes back to China.

“China gets the lion’s share of everything,” Khalid said, referring to CPEC investments. With Gwadar port, for instance, 90% of the quite limited revenue goes to the Chinese operating company. The Pakistani government receives 10%, while nothing goes to the Balochi regional government.

Mardell said that the CPEC and Gwadar port with it will likely continue despite all its issues.

“There’s no way that China will lose face and admit that it’s a disaster. And pulling out of CPEC and abandoning Pakistan isn’t an option now. They’re in too deep, and Pakistan is too important an ally,” he said.

Instead, he thinks it’s likely China will continue to drag its feet on large investments in Pakistan, but still show token amounts of effort to keep the project going.

Yet, he said, there’s still a chance for Gwadar. “If the situation in Pakistan changes for the better, then maybe CPEC will make progress.”