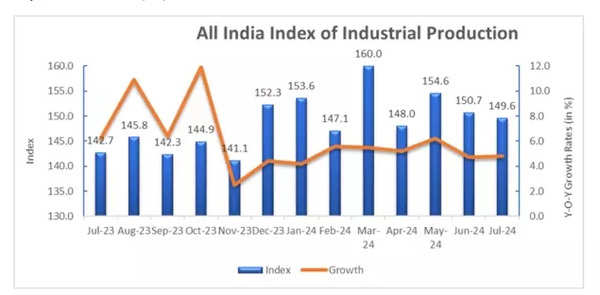

In July 2024, the Index of Industrial Production (IIP) growth rate reached 4.8 percent, a slight increase from the 4.7 percent recorded in June 2024.

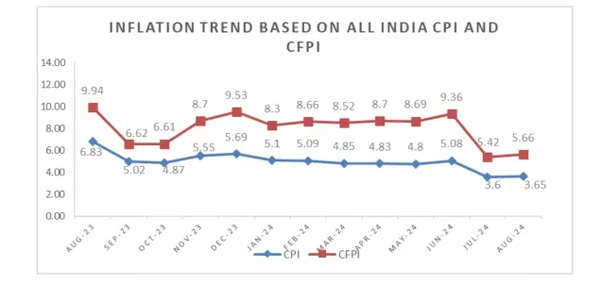

August CPI Inflation: Key Points

- According to the Ministry of Statistics and Programme Implementation, this is the second lowest retail inflation in the past five years. The rural and urban inflation rates stand at 4.16% and 3.14%, respectively.

- The food inflation rate for August 2024, based on the All India Consumer Food Price Index (CFPI), is provisionally reported at 5.66%, making it the second lowest since June 2023. The corresponding inflation rates for rural and urban areas are 6.02% and 4.99%, respectively.

- Several subgroups, including ‘Spices’, ‘Meat and Fish’, and ‘Pulses and products’, have experienced a decrease in inflation.

Inflation trend based on CPI data

Among individual items, ‘tomato’ has recorded the most significant year-on-year deflation at -47.91% and the largest month-on-month decrease in index at -28.8%.

July IIP data: Key points:

- The three main sectors – Mining, Manufacturing, and Electricity – experienced growth rates of 3.7 percent, 4.6 percent, and 7.9 percent, respectively, for the month of July 2024.

- The Quick Estimates of IIP for July 2024 stand at 149.6, compared to 142.7 in July 2023. The Indices of Industrial Production for Mining, Manufacturing, and Electricity sectors are 116.0, 148.6, and 220.2, respectively. Within the manufacturing sector, the top three positive contributors for July 2024 are “Manufacture of basic metals” (6.4%), “Manufacture of coke and refined petroleum products” (6.9%), and “Manufacture of electrical equipment” (28.3%).

- According to the use-based classification, the indices for July 2024 are as follows: Primary Goods at 150.1, Capital Goods at 114.4, Intermediate Goods at 164.3, and Infrastructure/Construction Goods at 178.7. The indices for Consumer durables and Consumer non-durables stand at 126.6 and 146.8, respectively.

- The corresponding growth rates of IIP as per the use-based classification in July 2024 compared to July 2023 are 5.9 percent for Primary goods, 12.0 percent for Capital goods, 6.8 percent for Intermediate goods, 4.9 percent for Infrastructure/Construction Goods, 8.2 percent for Consumer durables, and -4.4 percent for Consumer non-durables.

- The top three positive contributors to the growth of IIP for July 2024, based on the use-based classification, are Primary goods, Intermediate goods, and Consumer durables.

IIP Trend

Meanwhile, the Reserve Bank of India-led Monetary Policy Committee had kept the repo rate unchanged in the last policy review.

“The MPC may look through high food inflation if it is transitory; but in an environment of persisting high food inflation, as we are experiencing now, the MPC cannot afford to do so. It has to remain vigilant to prevent spillovers or second round effects from persistent food inflation and preserve the gains made so far in monetary policy credibility,” said RBI governor Shaktikanta Das in the August Monetary Policy review.