According to an ET report, analysts have looked at historical data from the past four decades during election years to gain insights.They anticipate that the benchmark index will deliver approximately 17% returns in 2024. This year alone, the Nifty has already seen an 18% rally.

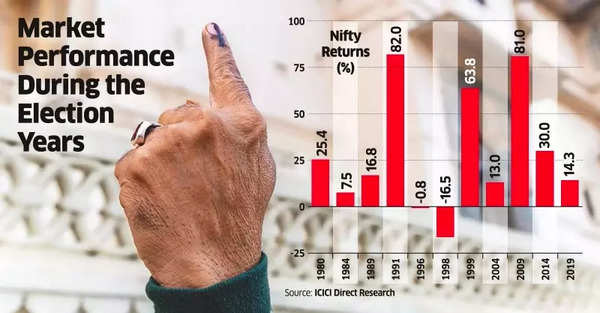

Looking back, equity returns during general election years have been positive in nine out of 11 instances, with a median return of 17%, according to ICICI Securities. For example, in 2019, the Nifty gained around 14.3%, while in 2014, it rallied by 30%.The significant surge of 81% in 2009 was a rebound from the sharp decline of 52% in 2008, which was triggered by the global economic crisis. In 1998 and 2004, the Nifty recorded gains of 63% and 13% respectively.

Market performance during election years

Analysts note that Indian equity markets exhibit specific characteristics during election years. Dharmesh Shah, head of technicals at ICICI Securities was quoted as saying that the calendar year 2024, being a Union Election year, will have a significant bearing on sentiments in equity markets. Shah said that it has been observed that benchmark indices have performed well in election years despite spikes in volatility, and hence, one should use volatility during election year as a buying opportunity.

Looking at the past four election years since 2004, Indian equities have consistently delivered positive returns, with the Nifty gaining a minimum of 11% and a median of 22%.

The banking, financial services, and insurance sectors, crucial market players, yielded double-digit returns in three of four election years. Additionally, sectors like auto, power, construction, and infrastructure have notably thrived in at least three election cycles. Defensive sectors like Consumption, Pharma, and IT have consistently shown stable performances across the past four election years.