Was the decision against changing rates because the new structure of the new tax regime actually kicks in from the current financial year?

Absolutely, we have opted for continuity and stability.Moreover, this was an Interim Budget.

What is the strategy for the medium term?

The effective tax rate is very reasonable. Similarly, on indirect taxes, too, customs duty is reviewed every year. We didn’t do it this time because it was an Interim Budget. In the medium term, the focus is on improving tax services, making things simple, rationalising taxes wherever required and using more technology to widen and deepen the tax base with more information and formalisation of the economy. We do not want too much change in tax rates.

Which are the segments where there is focus on widening the base?

No particular sector is on our mind. There are concerns over bogus or non-existent firms in case of GST and associated fake billing. The system, GSTN, is based on trust and we have seen benefits of trust-based compliance. But some dishonest people have used the system to pass on the credit and not pay tax. If you have passed on input tax credit, the system will check when you pay tax next month. If you have passed on the credit, it means you have collected tax from the buyer, so you must pay. Today, the system is giving freedom to taxpayers to change it. This was done for honest taxpayers but because of misuse, we will have to change this.

Is it time to rationalise GST slabs?

Changes are made by the GST Council. Major changes are based on recommendations of a group of ministers. As of now, there is no recommendation.

Is there a timeline in mind to phase out the old income tax regime and how are you looking to push the new regime?

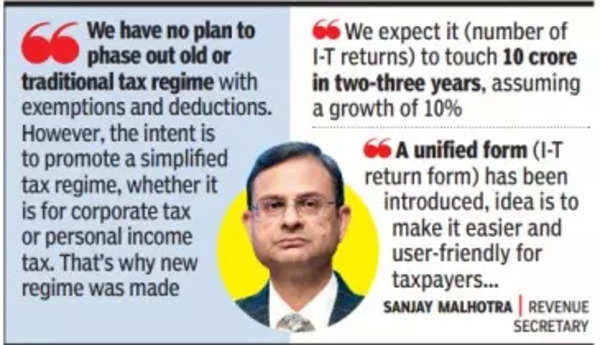

We have no plan to phase out the old or traditional tax regime with exemptions and deductions. However, the intent is to promote a simplified tax regime, whether it is for corporate tax or personal income tax. That’s why the new regime was made more attractive. By making the new regime the default scheme… and the tax calculator will help people decide which one to go for.

The number of income returns have crossed eight crore. How do you see it growing in the coming years?

We expect it to touch 10 crore in two-three years, assuming a growth of 10%.

There are very frequent changes to the income tax return form. How can there be more stability?

You are right, there is benefit in maintaining stability. A unified form has been introduced, the idea is to make it easier and user-friendly for taxpayers. Earlier, forms were designed for a paper-based return and then they were digitised. Now, we have done a transformation and looked at returns from an electronic returns point of view.

On the new scheme for pending demands, how do you plan to roll it out?

In two months, we want to implement the scheme. Taxpayers do not have to do anything because it is the income tax department, which will have to update its records. The maximum amount per person that will be withdrawn will be Rs 1 lakh, given that there can be multiple entries against one person. The number of entries is 1.1 crore and the number of unique beneficiaries will be less than one crore.

If you look at most frauds, PAN and Aadhaar are at the heart of it. Are you looking at ways to make PAN secure?

Earlier, banks were only asked if GST was linked to Aadhaar. Now we are tightening that. On GST, we are conducting a pilot in Gujarat and Puducherry, the registration is done on biometric authentication and not only on OTP. For biometrics, the person has to come to the centre. Biometric authentication for high-risk cases will be required.