Adani Green, in which Total Energies and GQG Partners own stake, will issue convertible warrants to the Adani family at Rs 1,481 apiece. The warrants, when converted into equity shares of the company within 18 months from the date of issuance in January 2024, will increase the family’s stake to 58.05% from 56.37%.The Adani Green stock ended at Rs 1,600 apiece on the BSE on Tuesday, up 4%.

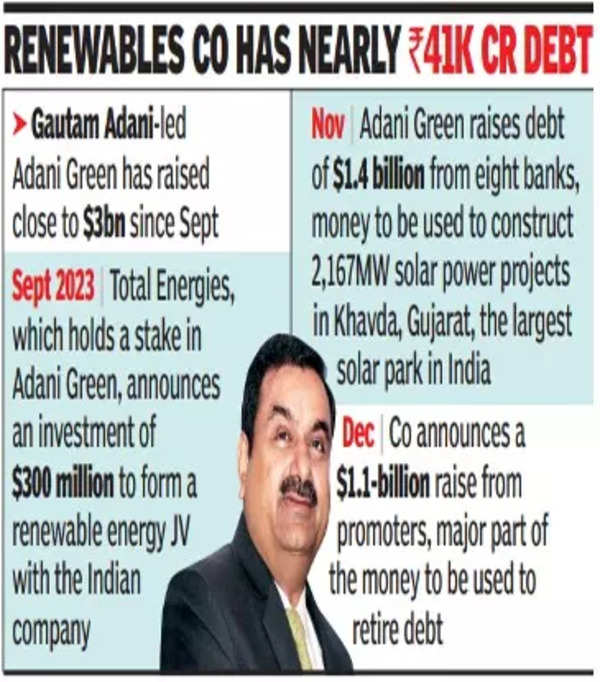

Adani Green had a debt of Rs 40,769 crore as of September-end 2023 and the proposed fund infusion comes as it braces for bond repayments in September 2024.

“India is on the cusp of becoming a global leader in renewable energy and Adani Green is in the vanguard of this revolution,” said its chairman Gautam Adani.

“This investment by the Adani family underscores our commitment… to an equitable energy transition where we phase down traditional power sources while simultaneously phasing up green, affordable alternatives to fuel our accelerating growth and development plans.”

Besides Gautam, his brother Rajesh Adani and his nephew Sagar Adani (Rajesh’s son) represent the family on the board of the renewables company.

The company will issue just over 6.3 crore warrants to Ardour Investment Holding and Adani Properties — entities that belong to the promoter group — and each warrant will be convertible into one equity share of Adani Green over 18 months from the allotment date, its notice to shareholders said. Currently, Adani Properties and Ardour Investment do not hold any shares of Adani Green, regulatory filings showed.

Adani Green, the notice said, intends to use half of the warrant proceeds of Rs 9,350 crore to repay loans and bonds to the tune of Rs 4,675 crore. It will use the balance to invest in renewable projects (Rs 2,338 crore) and for its ongoing expenses (Rs 2,337 crore). The company plans to have a renewable energy capacity of 45 gigawatts by 2030.