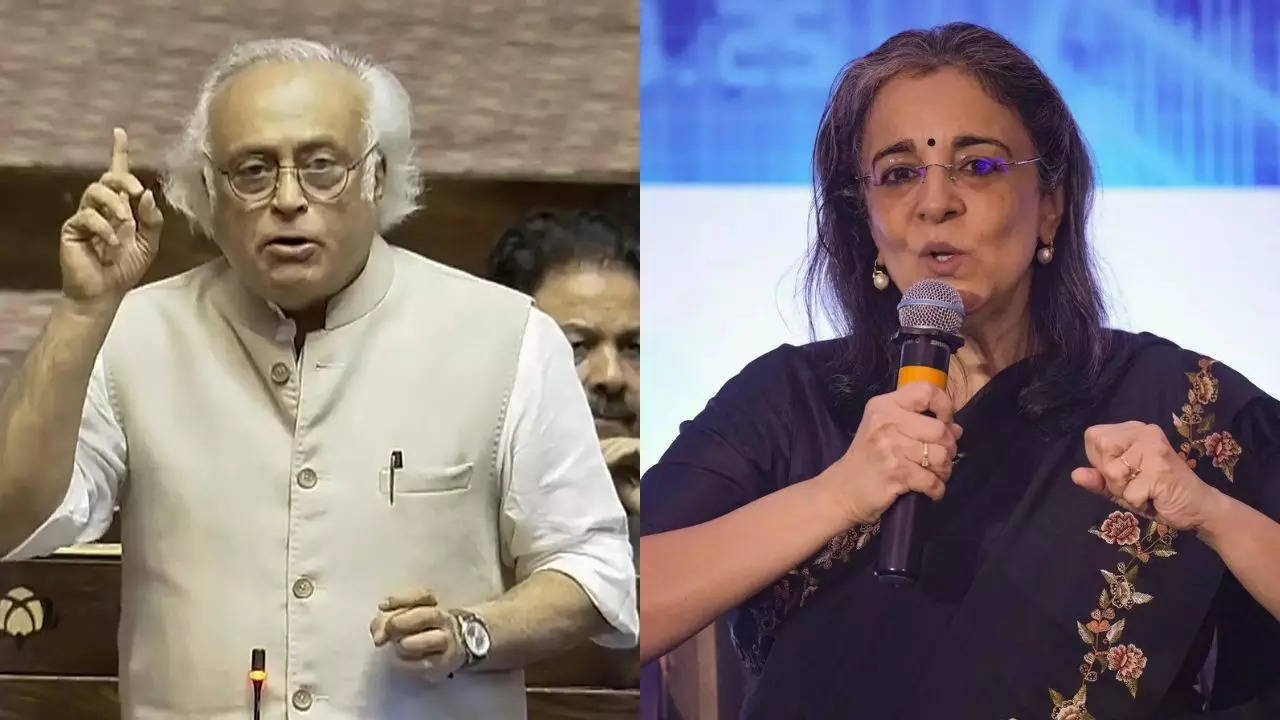

“The Sebi chairperson’s conflict of interest have already made a mockery of the Supreme Court-mandated Sebi investigations into the violations of securities laws by the Adani Group,” the grand old party’s spokesperson Jairam Ramesh said in a post on X.

“The Chairperson’s continuance in her role is untenable. She must resign, and a full Joint Parliamentary Committee (JPC) investigation must be conducted into the Adani Mega Scam,” he added.

Ramesh cited a report by The Morning Context which said that Sebi chairperson Madhabi Puri-Buch’s close ties with the American private equity firm Blackstone have sparked concerns about potential conflicts of interest.

“The Morning Context has just brought to light other conflicts of interest relating to the Sebi chairperson. These involve the private equity firm Blackstone where her husband is employed as a senior advisor. There appears to be at least one case involving Blackstone and Sebi from which she had not exempted herself from (or in legal language, recused herself),” Ramesh said.

The report said that although Buch had said that she had recused herself from all matters related to Blackstone, it’s important to note that Blackstone, through its various subsidiaries, either owns or has substantial stakes in several major companies. These include Indiabulls Housing Finance (now Sammaan Capital), Aadhar Housing Finance, asset and wealth management firm ASK Investment Managers, hospital chain Care Hospitals, and IT services provider Mphasis.

“Blackstone is heavily invested in India. It is the promoter of many companies in India. That she has recused herself from Blackstone matters isn’t enough given the amount of investment they have in India,” a veteran fund manager told The Morning Context.

Hindenburg, in its report, had accused Buch and her husband, Dhaval, of being involved with offshore funds in the alleged Adani money siphoning scandal.