Most women who are independent in making financial decisions are either over the age of 45 or they earn more than Rs 40 lakh in a year, a study showed. Which city women call home is another factor that determines financial independence.

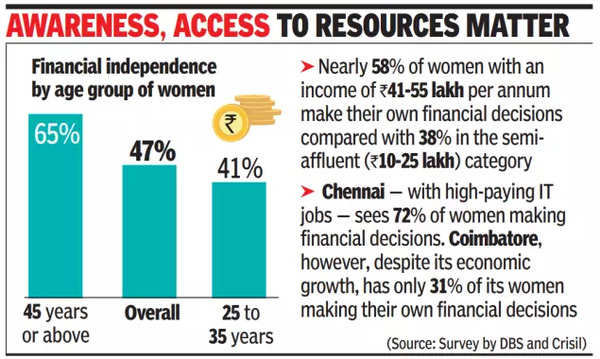

While 47% of the women earning more than Rs 10 lakh per annum said they took financially independent decisions, the number was lower (41%) for younger women and the not-so-affluent ones. On the other hand, about 65% of women over 45 years of age said they enjoyed financial freedom, the study by DBS & Crisil showed.

“Given that the current participation of women in the Indian labour force is just 37% and the gender pay gap is not decreasing fast enough, insights from this study will have implications for policymaking, the financial sector, and society at large,” said DBS Bank India MD & CEO Surojit Shome.

DBS and Crisil surveyed women across the country aged 25 and above, with incomes starting at Rs 10 lakh per annum, and professionals as well as salaried women in industries such as IT, education, pharma, BFSI and consulting.

The increased financial independence with age could be attributed to experience and an improved understanding of financial products.

Affluence also makes a huge difference in independence when it comes to financial decision-making – nearly 58% of women with an income of Rs 41-55 lakh per annum make their own monetary decisions compared with 38% in the semi-affluent (Rs 10-25 lakh per annum) category. This disparity can be attributed to affluent women having higher financial literacy and a greater access to resources.

The regional disparity in financial independence is stark, too. Chennai – with high-paying IT jobs and a global work culture – sees 72% of its women confidently making financial decisions. Coimbatore, however, despite its economic growth, has only 31% of its women taking financial decisions independently. While 65% of women in Delhi steer their own financial decisions, driven by the city’s cosmopolitan culture and myriad opportunities, Gurugram presents a contrasting picture with only 44% of women making independent financial decisions.

The study also looked at the financial priorities of respondents. Even as the top priority was to own or upgrade their homes (21%) in the West, in the North, the top priority was planning for retirement (17%). Interestingly, children’s education is a top priority in the East (33%) and the South (28%).