Aussie landlords have revealed how they determine whether someone will be a good tenant – and some of their methods are very unusual.

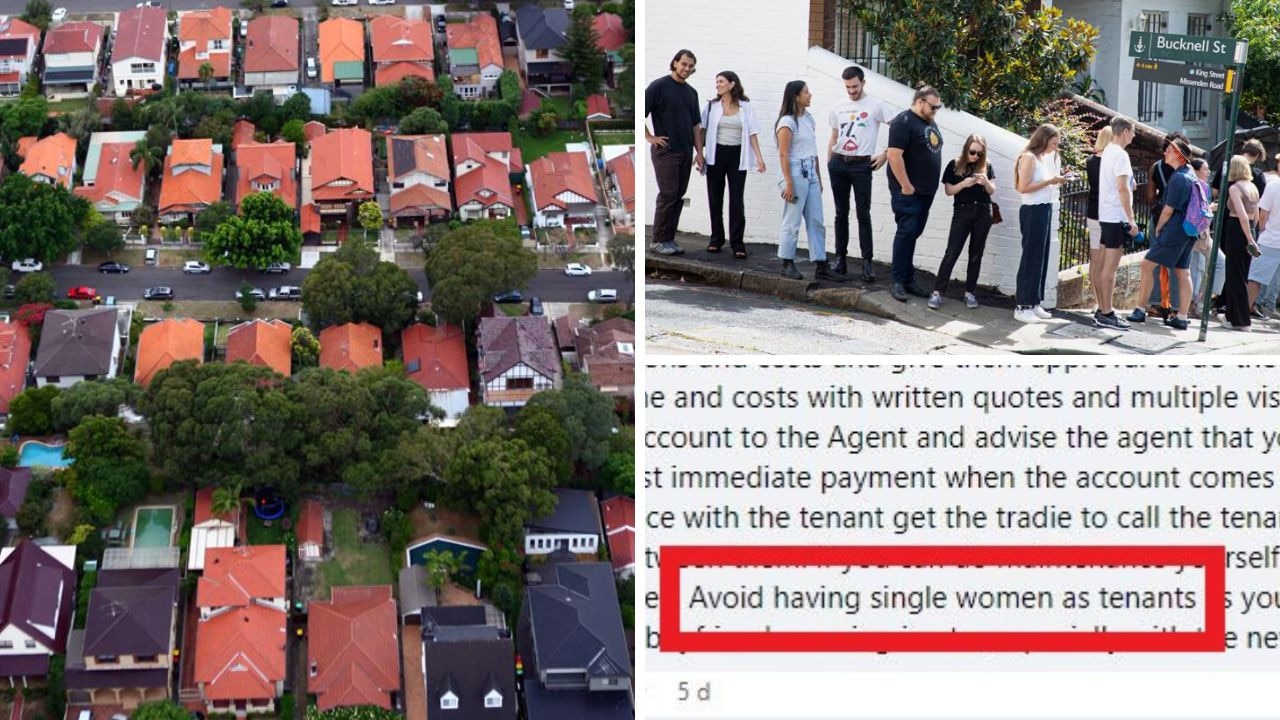

Anyone who has been on the hunt for a rental property within the last year knows that you are often competing with dozens of applicants for a single property.

The rental crisis means it is more important than ever to make a good impression on your application – and now we have some insight into what landlords are really looking for.

A soon-to-be landlord in NSW recently posted in a Facebook group for Aussies with investment properties asking what other members look out for when approving a tenant and what they wish they knew when leasing for the first time.

Dozens of people commented on the post, spilling their secrets on the key qualities they look for in a new tenant.

A common theme was income, with multiple landlords advising the poster to ensure any prospective tenant had a solid amount of money in savings and enough money coming in to cover the rent.

“Jobs, money in the bank, good history etc but I went with my gut too and it has served me well every time,” one commenter said.

“Clear rental ledger, clear rental history. A family (long term) is a good choice less chance of them breaking up and not being able to cover rent. Good income. Don’t let the rent exceed 30 per cent of their wage,” another said.

However, one landlord noted that with rents skyrocketing, it was “pretty hard” to stick to the 30 per cent rule.

Instead, this landlord claimed an “unblemished rental ledger” and preference towards applicants with a history of long term tenancy was best.

These are pretty standard factors that you would expect landlords to be looking out for but there were also some strange, and downright shocking, suggestions in the comments.

One landlord advised against having “single women as tenants”.

“You run a risk with DV problems, boyfriends moving in etc., especially with the new DV laws,” he wrote.

In NSW, there are a number of rules in place to protect victims of domestic violence who are also renters.

Under the law, if a tenant or their dependent child are in circumstances of domestic violence, they can end their tenancy immediately without being penalised.

This means that the landlord cannot issue the victim with breach fees or costs for property damage caused by the domestic violence perpetrator.

A landlord is also not allowed to list information about a tenant in a tenancy database when the tenant has terminated the agreement in circumstances of domestic violence.

Other than his opinions on the “risk” associated with renting to single women, this landlord also advocated for giving your number to the tenant so they can contact you directly.

He claimed this allowed you to save money on “unnecessary call outs” for maintenance issues, claiming real estate agents were “invariably crap at managing maintenance and get ripped off by tradies”.

Other landlords claimed they could tell if a tenant was going to look after the property by requesting a photo of their pets or car.

“If they have dogs I like to see pictures of them so that I can tell they’re well cared for. I’ve found people that take care of their dogs tend to take care of everything in their life… bit anecdotal but it has rung true so far,” one person said.

Another agreed, saying you can “tell a lot about people by the condition of their pets”.

One landlord had the same theory about people’s vehicles, telling the poster to “check out” prospective tenant’s car.

“If they don’t look after that they won’t look after your house,” they claimed.

Unfortunately for tenants, it appears that the rising rental costs aren’t going to come down any time soon, despite signs of slowing inflation.

Recent data from the Australian Bureau of Statistics revealed rental expenditure recorded an increase of 2.5 per cent over the June 2023 quarter and a whopping 6.7 per cent over the 12 months to June 2023.

This is the biggest quarterly rental increase in 25 years, with PropTrack economic research director Cameron Kusher saying historically slow stock and vacancy rates combined with high demand means bad news for renters.

“Throughout the pandemic, advertised rents surged. Now, CPI rents, which encompass all rents, not just new ones like advertised rents, are catching up, with the strongest increases in many years,” Mr Kusher said.

“With limited supply and historically low vacancy rates, there’s no relief in sight for renters. Demand remains well above pre-pandemic levels and properties are continuing to lease quickly.

“Although overall inflationary pressures are easing, it seems that renters are likely to face further price escalations for some time yet.”