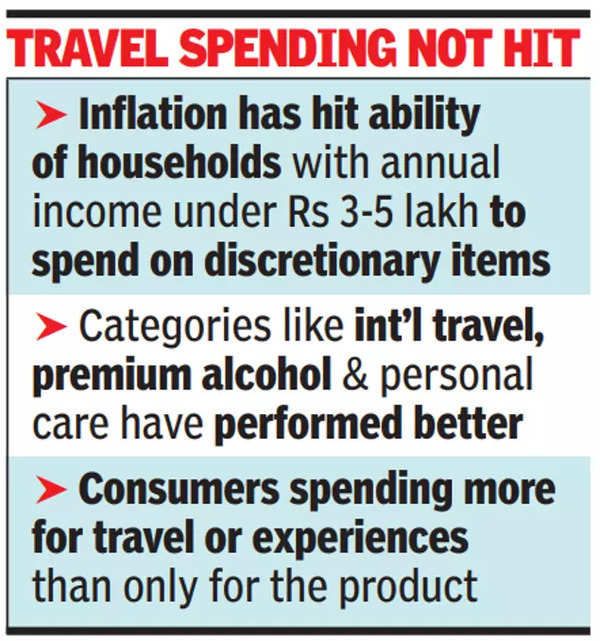

Bata India, for instance, said the mass market segment continues to be a “drag” on its overall growth even as its portfolio of premium brands have seen robust demand. Tanishq has seen a slowdown in the sub 50,000 and 1,00,000 categories (in terms of transactions by new customers). And, in the quick service restaurant space, pricey gourmet pizzas seem to be the flavour of the season. “Lower-income households (under 3-5 lakh annually) have been hit the most. High inflation has reduced the ability to spend on discretionary items,” said Rishav Jain, MD at consulting firm Alvarez & Marsal.

‘Consumer sentiment still subdued’

However, discretionary spending of the top three-five crore households (earning over Rs 10-15 lakh annually) is less impacted. Categories such as international travel, premium alcohol, premium beauty and personal care, premium home improvement have performed relatively better. In macroeconomic terms, we call it the K-curve,” Jain added.

Brands with a good part of their consumers extending to lesser affluent households and deepening their presence to smaller cities have witnessed low or negative same-store sales growth in the past few quarters, analysts said. Companies are struggling to get consumers to transact more, with even the festive season having failed to fuel mass discretionary consumption.

“Consumer sentiment remains subdued, despite the third quarter traditionally being a strong and festive quarter… reflecting a cautious approach to mass discretionary spending,” said Ravi Jaipuria, non-executive chairman at Devyani International, which operates brands like KFC, Pizza Hut and Costa Coffee in India. The eating-out frequency has actually “degrown” or fallen, said Akshay Jatia, executive director at Westlife Foodworld, which runs McDonald’s outlets in west and south India. The trend has prompted Devyani International to slow down expansion plans for Pizza Hut stores, with 60-70 stores a year planned against 100 earlier.

In the age of social media which often nudges consumers to try fresh styles, apparel hasn’t found many takers either. Shoppers Stop continues to see a muted growth, particularly in women’s western wear and partly in menswear, said CEO and executive director Kavindra Mishra, adding that a delayed winter has also weighed on winter wear sales. Also eating into the share of retail spends is a growing inclination among affluent customers to allot more budgets towards travel and experiences. “We are definitely seeing a shift in consumer spend… people are spending more for travel or experiences rather than only buying for the product,” Mishra said. Highlighting the correlation between the companies and industries and the income classes they service, executives at the Titan Company pointed out how staples and motorcycles are seeing a sluggishness but categories like travel, hospitality, experiences, vacations and SUVs had picked up.

The FMCG sector also has had its own share of struggles, clocking 2.7% volume growth in 2023, driven entirely by growing population and not consumption.