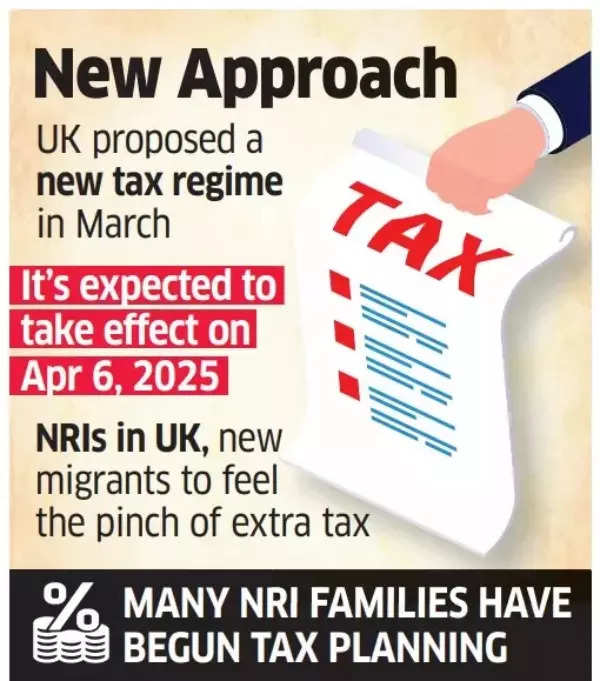

According to an ET report, tax experts and lawyers have been strategizing to mitigate the effects of this upcoming tax overhaul.The proposal aims to end the current tax treatment for UK resident non-domiciled (non-doms) individuals. Indian income and capital gains of NRIs are currently not taxed unless remitted to the UK.

Under the new regime, individuals arriving in the UK will not be taxed on their foreign income for the first four years of residency. However, starting from the fifth year, UK residents will be liable to pay taxes on their worldwide income, including earnings from sources like rent, bank fixed deposits, and stocks in India.

New Proposed Tax Regime in UK

Existing NRIs who migrated two years ago as non-doms will be able to claim tax relief on their foreign income for the remaining 2 years period. Dinesh Kanabar, CEO of Dhruva Advisors LLP was quoted as saying, “Present tax rates in the UK for the highest tax band is 40% for dividend income and 45% for other income. As against this, the tax rate for the highest band in India is 10% for dividend income under the India-UK tax treaty, 28% on rental income after considering standard deduction and 40% for other income. So, this will lead to additional tax leakage of 30% on dividend income, 17% on rental income and 5% on other income for NRIs under the new regime.”

Also Read | Mini-Goldilocks moment! Why Motilal Oswal thinks India is big, bold and blazing

The proposed framework outlines that NRIs who have been in the UK for a decade and are currently non-doms will face a tax rate of 50% on their foreign income in the initial year. Additionally, remittances towards pre-2025 foreign income will be taxed at 12% for the first two years.

Kanabar suggested that Indian families considering migration to the UK may postpone their plans until after the next UK election, anticipating a possible revision of the tax regime by the incoming government. Families already residing in the UK are advised to assess the impact of the new tax rules on their income sources and inheritance planning.

Wealthy NRI families with offshore trusts may need to reevaluate their trust structures and distribution strategies to align with the changing regulations. Mitil Chokshi, a senior partner at Chokshi & Chokshi, emphasized the need for strategic financial planning in light of the impending tax adjustments.

Also Read |India’s Mission 2047: How India aims to become a developed economy – high speed expressways, electric mobility, digital payments & more

The debate is ongoing on whether the shift towards taxing global income will diminish the appeal of the UK as a destination for wealthy individuals. The reduction of the non-dom period to four years may make the UK less attractive compared to countries like Spain, Portugal, and Switzerland, which offer more favorable tax regimes.

Experts in the field, including Rajesh Shah from Jayantilal Thakkar & Company and Uday Ved from KNAV, highlighted the potential need for NRIs to restructure their investments and income streams due to the new tax regulations.