The disclosure was made by Ervin Tu, the interim group CEO of Prosus and Naspers, during the firm’s post earnings call on Wednesday.

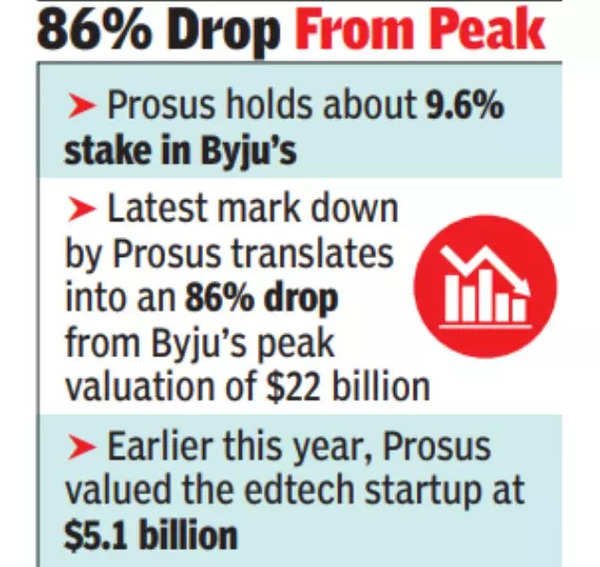

“We have reported a markdown in the Byju’s current value. We have written it down by a further $315 million, so our effective valuation on Byju’s is sub $3 billion. It doesn’t necessarily reflect the long-term view of the business. It reflects the current trading circumstances,” Tu said. Byju’s is confronting multiple headwinds and the firm’s shareholders are working everyday to improve the situation. “We are in close discussions with the company everyday,” Tu said.

Earlier this year, Prosus valued the startup at $5.1 billion. In a statement in July, Prosus had revealed that its representative Russell Dreisenstock resigned from the company’s board because the executive leadership at Byju’s regularly disregarded his advice relating to strategic, operational, legal and corporate governance matters.

In its earnings presentation for April-September, Prosus listed Byju’s and PharmEasy among “large underperformers” within its portfolio, impacting the investor’s internal rate of return. “Another was a write down in PharmEasy of about $118 million and that’s really driven by the need for PharmEasy to raise money to settle debt…we participated in that round, which expresses our confidence in the business going forward,” Tu said.

Prosus, which counts India as one of its key markets. said opportunity here is wide and it remains bullish. Swiggy is a promising bet, the firm said, adding. food delivery startup has made great strides to improve growth and profit trajectory. Besides, its payments arm PayU India is headed for an IPO in second half of next year. “We are working very hard to prepare the business…to be in listable form,” Tu said.