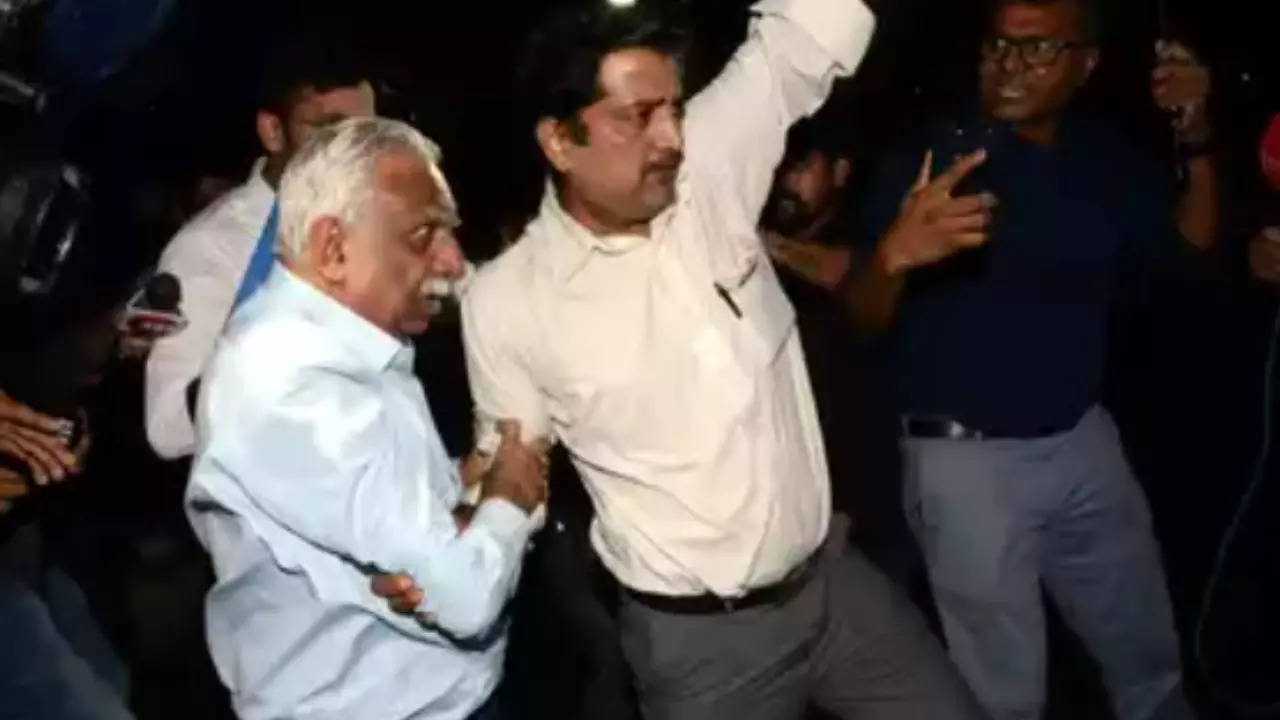

MUMBAI: The Enforcement Directorate (ED) late on Friday arrested Jet Airways founder Naresh Goyal in a money-laundering case linked to the Rs 539-crore Canara Bank loan fraud case.

ED officials questioned Goyal for hours at its Mumbai office and added he was not cooperating in the investigation. Goyal was brought from Delhi to Mumbai ED office for questioning and later placed under arrest, sources said. ED will produce him in court on Saturday.

The ED probe is based on a May 3 case filed by CBI on the complaint of Canara Bank. Jet Airways (India) Ltd has been dealing with Canara Bank since 2005, and all the exposures are under State Bank of India (SBI)-led consortium arrangements. CBI had also named Goyal’s wife Anita, Gaurang Shetty and unknown persons as accused in the FIR.

As per the bank’s complaint, when Goyal’s companies started defaulting on repayment of loans availed from the consortium, the bank carried out a forensic audit of all the transactions and documentations processed between April 1, 2011, and June 19, 2019, which pointed out diversion and siphoning of funds. The report was submitted in 2021.

In July 2023, ED had searched around eight premises in the city and Delhi, including auditor Rajesh Chaturvedi.

Jet Airways took loans from banks for the purpose of landing, navigation and utilisation of services at various airports, for security deposits for lease rentals with regard to import of aircraft and also for securing payment of variable rentals. The loans were also taken to support its plan to turn around the company, for introduction on new routes and business promotion. But the airlines siphoned off the money, CBI alleged.

The company claimed that since August 2018, it was facing liquidity and operational issues. Jet Airways came under financial stress and was not able to service its loan repayment, it had said.

The audit report identified three key modus operandi for siphoning of funds by Jet Airways: through commission expenses, through its investment in subsidiary company Jet Lite (India) Ltd, and through making professional consultancy expenses.

The audit further showed siphoning of funds through Jet Lite (India) Ltd through advance and investing as well as subsequently writing off the same by making provisions.

The account was declared as fraud and reported to the RBI on July 29, 2021, for Rs 728.6 crore of which Rs 538.6 crore pertains to Canara Bank and Rs 190 crore to the erstwhile Syndicate Bank.

In the past, ED had questioned Goyal in separate money laundering and Foreign Exchange Management Act violation cases, including the Yes Bank loan fraud. ED had also probed Goyal in a money laundering case it had registered on a Mumbai Police FIR on a cheating complaint by a travel agency. The police closed the case and since the predicate offence no longer existed, the ED case collapsed. ED challenged it in the Bombay high court without any success.

ED officials questioned Goyal for hours at its Mumbai office and added he was not cooperating in the investigation. Goyal was brought from Delhi to Mumbai ED office for questioning and later placed under arrest, sources said. ED will produce him in court on Saturday.

The ED probe is based on a May 3 case filed by CBI on the complaint of Canara Bank. Jet Airways (India) Ltd has been dealing with Canara Bank since 2005, and all the exposures are under State Bank of India (SBI)-led consortium arrangements. CBI had also named Goyal’s wife Anita, Gaurang Shetty and unknown persons as accused in the FIR.

As per the bank’s complaint, when Goyal’s companies started defaulting on repayment of loans availed from the consortium, the bank carried out a forensic audit of all the transactions and documentations processed between April 1, 2011, and June 19, 2019, which pointed out diversion and siphoning of funds. The report was submitted in 2021.

In July 2023, ED had searched around eight premises in the city and Delhi, including auditor Rajesh Chaturvedi.

Jet Airways took loans from banks for the purpose of landing, navigation and utilisation of services at various airports, for security deposits for lease rentals with regard to import of aircraft and also for securing payment of variable rentals. The loans were also taken to support its plan to turn around the company, for introduction on new routes and business promotion. But the airlines siphoned off the money, CBI alleged.

The company claimed that since August 2018, it was facing liquidity and operational issues. Jet Airways came under financial stress and was not able to service its loan repayment, it had said.

The audit report identified three key modus operandi for siphoning of funds by Jet Airways: through commission expenses, through its investment in subsidiary company Jet Lite (India) Ltd, and through making professional consultancy expenses.

The audit further showed siphoning of funds through Jet Lite (India) Ltd through advance and investing as well as subsequently writing off the same by making provisions.

The account was declared as fraud and reported to the RBI on July 29, 2021, for Rs 728.6 crore of which Rs 538.6 crore pertains to Canara Bank and Rs 190 crore to the erstwhile Syndicate Bank.

In the past, ED had questioned Goyal in separate money laundering and Foreign Exchange Management Act violation cases, including the Yes Bank loan fraud. ED had also probed Goyal in a money laundering case it had registered on a Mumbai Police FIR on a cheating complaint by a travel agency. The police closed the case and since the predicate offence no longer existed, the ED case collapsed. ED challenged it in the Bombay high court without any success.