The cost-of-living chaos gripping many Australian households is worsening, with even those on six-figure salaries feeling high levels of financial stress, new research shows.

The latest Bill Stress Index compiled by Compare Club found 30 per cent of all households are spending between 50 per cent and 70 per cent of their income on bills.

Alarmingly, even those Australians on ‘upper-middle’ salaries are struggling, with 52 per cent of respondents with an individual income of $125,000 feeling ‘highly stressed’.

The biggest bugbears at present for those on strong incomes are energy (49 per cent), mortgages (34 per cent), and general insurance (21 per cent).

Young people, parents and low-income earners have shown the largest increase in financial stress levels, the index found.

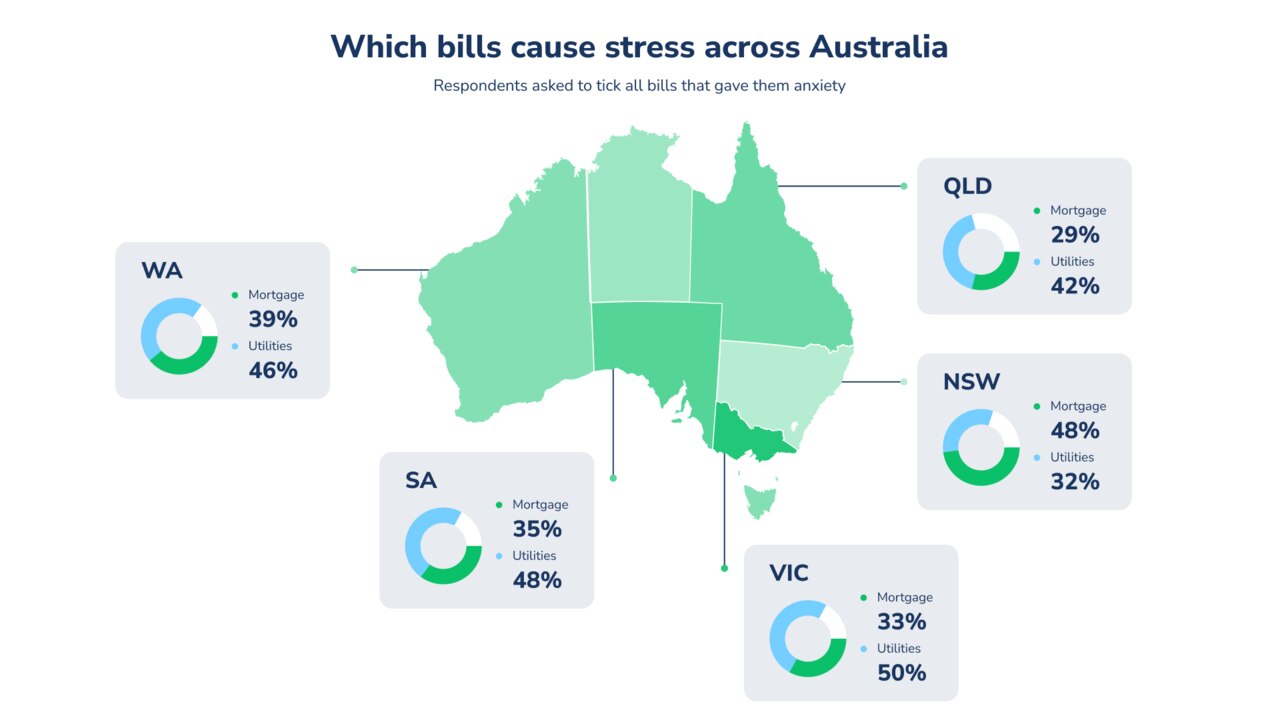

But almost half of all respondents are anxious about being able to afford their utility bills, up considerably from 23 per cent since the last index was compiled in May.

Other bills causing households the most stress are mortgages (33 per cent), rents (24 per cent), and general insurance (22 per cent), Compare Club found.

The findings mirror those from financial comparison website finder.com.au, with 79 per cent of households feeling ‘somewhat’ or ‘extremely’ stressed about their finances.

‘Huge amounts of stress’

The biannual Bill Stress Index also found 27 per cent of households are spending between a third and a half of their income each month, while 12 per cent are forking out more than 75 per cent.

And in perhaps the strongest sign of bill stress, people aged between 35 and 44 are spending 75 per cent or more on monthly bills, representing a whopping 220 per cent increase since May.

“This increase in bill-related anxiety in such a short amount of time really shows the real impact of inflation and the rising cost of living on Australians,” Compare Club’s Head of Research Kate Browne said.

“It’s quite clear that the strategy of raising rates to manage the economy is putting many people under a huge amount of financial stress.”

Overall, those living in Queensland are most stressed (49 per cent), followed by Western Australia (47 per cent), New South Wales (46 per cent), South Australia (45 per cent), and Victoria (44 per cent).

More than 71 per cent of respondents report cutting back on non-essential spending to cope with cost-of-living pressures.

The cost-of-living crisis has “wreaked havoc” on many households this year, Graham Cooke, Head of Consumer Research at finder.com.au, said.

“Everything from housing to groceries, petrol and energy costs more, and economic conditions are some of the worst in decades,” Mr Cooke said.

A report by the not-for-profit crisis service Foodbank Australia found half a million households are battling to put food on the table on any given day.

More than 3.7 million households ran out of food in the past year because of limited finances, sometimes skipping meals or going without for whole days.

“We know how important it is for people to have access to nutritious food, yet the rising costs of energy, fuel, groceries, rent and mortgages have put this fundamental need beyond the reach of more and more people with no respite in sight,” Foodbank chief executive Brianna Casey said.

The group is facing an “unprecedented” demand for help in the lead-up to Christmas, with demand rising 200 per cent in some parts of the country.

In Victoria alone, Foodbank is helping to feed about 57,000 people each day. Nationally, 60 per cent of those reaching out have at least one person in paid work.

Mortgage costs rising

How much Aussie homeowners are forking out on average each month on mortgage repayments has now hit $3883, according to analysis by Canstar.

That’s risen by about $1800 per month on average since the RBA began hiking rates in May 2022.

Roy Morgan’s latest research shows 1.51 million mortgage holders are now at risk of experiencing mortgage stress – a staggering increase of 700,000 households since interest rates began increasing.

The number of homeowners considered to be ‘extremely at risk’ has hit 967,000, or almost one-fifth of all mortgage holders, which is well above the long-term decade average of 14.1 per cent.

The last time extreme mortgage stress levels were this high was in the wake of the Global Financial Crisis, Roy Morgan chief executive Michele Levine said.

“Rising interest rates over the last year have caused a large increase in the number of mortgage holders considered ‘at risk’,” Ms Levine said.

“Further increases in the months ahead will spike these numbers even further even as people adjust their lifestyle choices to deal with increased payments.”

The cost of servicing that mortgage based on the current standard interest rate is about $3202 per month.

That amount has leapt by almost $1400 per month since rates began rising.

Compare Club’s Bill Stress Index found 33 per cent of homeowners are worried about how much their repayments are, up sharply from 27 per cent in May.

Meanwhile, the average size of a mortgage for first-home buyers has hit $507,000, new data from the Australian Bureau of Statistics shows.

That’s some $100,000 more than before the Covid-19 pandemic, on the back of soaring property prices and the impact of 13 rate rises in just 18 months.

Rents set to soar higher

An expert panel of 38 economists and financial analysts surveyed by finder.com.au found the vast majority expect rental prices to continue rising throughout 2024.

The panel expects Perth rents to jump by about 9.5 per cent by the end of next year, while Melbourne prices could increase 6.8 per cent and Sydney costs might rise by 6.5 per cent.

Based on those forecasts and price modelling, the minimum household income needed to afford rent in Sydney is a staggering $127,339 – the highest amount in the country.

More than 42 per cent of tenants are already struggling to cope with the cost of leasing their home, Mr Cooke said.

“Much of the conversation around rate rises focuses on homeowners, but it’s actually renters who are proportionally feeling the impact more, as they deal with flow-on rent increases,” he said.

“Further rent increases won’t be welcome news for those struggling.”

Professor Mark Crosby from Monash University’s Business School said surging demand and limited supply will inevitably see cost increases continue.

“Lack of supply is likely to continue to impact the rental market, especially as migration continues to put pressure on this market,” Professor Crosby said.

Pollies demand supermarket action

A Senate inquiry examining supermarket pricing amid the cost crunch will begin in Canberra, with calls from one political leader to impose strict fines for gouging.

The wide-ranging probe will look at everything from arrangements with suppliers to unnecessary price increases.

National Party leader David Littleproud wants the government to use a big stick to encourage Woolworths and Coles to do the right thing.

“The biggest penalty for supermarkets at the moment for stitching up suppliers and their consumers is $64,000 under the grocery code of conduct, but it should be $10 million plus,” Mr Littleproud said.

“The cost-of-living crisis is now, not in the middle of next year, people are going to struggle to put a Christmas ham on the table.”

More relief unlikely

Speaking to reporters in Canberra yesterday, Treasurer Jim Chalmers talked down the likelihood of further government support for Australians doing it tough.

Those struggling with the cost-of-living crisis and mortgage stress “shouldn’t anticipate big new measures” before the government hands down its next budget in May.

That’s despite next week’s mid-year economic review from the government set to show “a much healthier set of books” and the budget operating on a $9 billion surplus.

“We understand and recognise that people are under substantial cost-of-living pressure, but we are making welcome and encouraging progress in this fight against inflation,” Dr Chalmers said.

“Our cost-of-living plan is targeted to take some of the edge off these cost-of-living pressures without adding to inflation.”