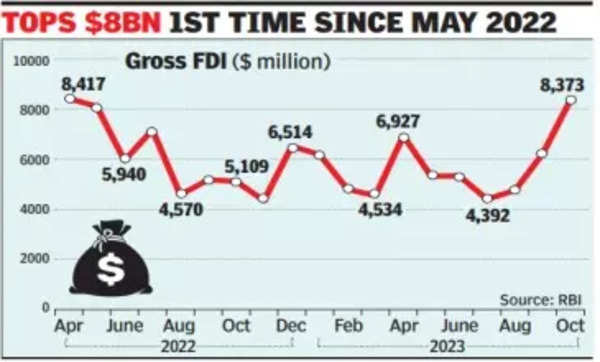

Latest data released by RBI showed that on a gross basis, inflows increased for three months in a row, although between April and October 2023, FDI flowing into the country was estimated to be 6.7% lower at $41.5 billion, as against $44.5 billion in the corresponding period last year.

The fall has come at a time when the government is courting investors, positioning India as an attractive destination for companies from the US, Europe and Japan that are looking to diversify their manufacturing bases beyond China. The government has blamed the weak global sentiment and the geo-political risks for falling FDI.

The government has been pushing companies such as Apple and Tesla to invest in India and is offering schemes such as production-linked incentives to woo domestic and global investors to cater to the domestic and export markets. The numbers in October come on the back of a 20% increase in September and mark the first time since May 2022 when inflows topped $8 billion.

On the gross side, the inflows were bolstered by a $3.6 billion worth acquisition of shares, while inflows via the RBI route hovered around the $2.5 billion mark. Reinvested earnings remained unchanged at $1.7 billion. October also saw repatriation or disinvestment of $1.1 billion in October, sharply lower than the $2.9 billion a year ago.

Earlier this month, UN ESCAP said that for the second year in a row, India was the highest recipient of FDI, which was $68 billion, down 4% from 2022, driven by greenfield investments. “India has seen several mega deals in 2023 across sectors including communications, semiconductors, automotive OEM, software, biomass power and more from companies including NTT, Micron Technology, Hyundai, Suzuki, Microsoft and others,” it said.

In a recent report, OECD said that in the first half of 2023, FDI flows globally rebounded to $727 billion from very low levels recorded in the second half of 2022 but remained 30% below the level recorded in the first semester of 2022.

The report noted that inflows have been hit by weak M&A activity, while capex has been holding up. “The US, India, Mauritania, the UK, and Brazil received the most significant projects,” the OECD report had said.