This was among several key action points that emerged at end of the meeting of fintech and startup companies with FM Nirmala Sitharaman on Monday. During the meeting, it was emphasised that innovative solutions by the fintech companies are essential to the financial services sector, while ensuring strict compliance with regulations.

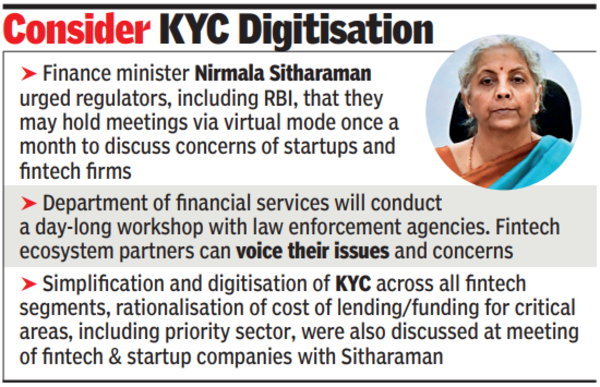

Sitharaman urged the regulators, including RBI, that they may hold meetings via virtual mode once a month to discuss any questions or concerns of the startups and fintech firms. The department of financial services will conduct a day-long workshop with law enforcement agencies, where fintech ecosystem partners can voice their issues and concerns.

The meeting comes against the backdrop of RBI’s move to curb operations of Paytm Payments Bank over persistent non-compliance. The fintech and startups did not display any anxiety over the Paytm Payments Banks issue, sources said, adding that they reassured authorities about their commitment towards following regulatory mechanisms and norms.

The other action points that emerged from the meeting include simplification and digitisation of KYC across all fintech segments, cost of lending/funding for critical areas including priority sector should be rationalised. The Department for Promotion of Industry and Internal Trade informed that new patent examiners have been added, which will reduce the turn-around-time of patent applications.

FM noted the rapid growth of the startup and fintech sector in India, especially in the last decade, and welcomed suggestions to achieve greater ease of doing business and ease of living for consumers. The interaction with the startup and fintech ecosystem partners was organised to enable exchange of ideas to bolster and scale up operations to facilitate global competitiveness by enabling growth in the fintech sector. India has approximately 10,244 fintech entities, which is the third largest in the world, according to a statement. The number of startups in India has grown significantly from just over 300 in 2016 to over 1.2 lakh in 2023 as recognised by DPIIT, generating more than 12.4 lakh jobs, and 47% of them have at least one women director.