The growing reliance on personal income taxes to prop up government coffers is an “intergenerational tragedy”, former Treasury boss Ken Henry has claimed.

Dr Henry, who authored the landmark Henry Review of Australia’s tax system that was commissioned by the first Rudd government, has implored Treasurer Jim Chalmers to embark on wholesale tax reform to halt a slide in living standards.

The intervention follows the release of the latest Intergenerational Report (IGR) that revealed more of the income tax burden would be shouldered by a shrinking proportion of workers to pay for a growing share of older Australians who require aged care and other social assistance.

“As the population ages, the personal income tax base is projected to continue to narrow in line with the projected decline in workforce participation,” the IGR said.

But federal Treasurer Jim Chalmers, who launched the report’s sixth iteration at the National Press Club on Thursday, has ruled out an extensive reform package to Australia’s tax and transfer system.

Instead, Dr Chalmers said the government would focus on pursuing incremental reform in what it called “bite-sized chunks”, including changes to the petroleum resource rent tax, multinational tax avoidance rules and high-balance superannuation accounts.

Speaking on ABC Radio National Breakfast on Friday, Dr Henry said the government needed to be more ambitious if it wanted to avoid damaging Australia’s economic performance and reducing the living standards of young Australian workers as they grow older.

“It’s the young people who are going to be the workers of the future,” Dr Henry said.

“People who are weighed down with HECS debt, who are going to have to repay a mountain of public debt, who are dealing with the consequences of climate change … who are facing diminishing prospects of ever being able to afford a home of their own.

“These poor buggers are also going to be the ones who are facing ever-increasing average rates of income tax.”

As inflation pushes workers’ incomes into higher tax brackets, a great proportion of their pay packets will be subject to a higher tax rate.

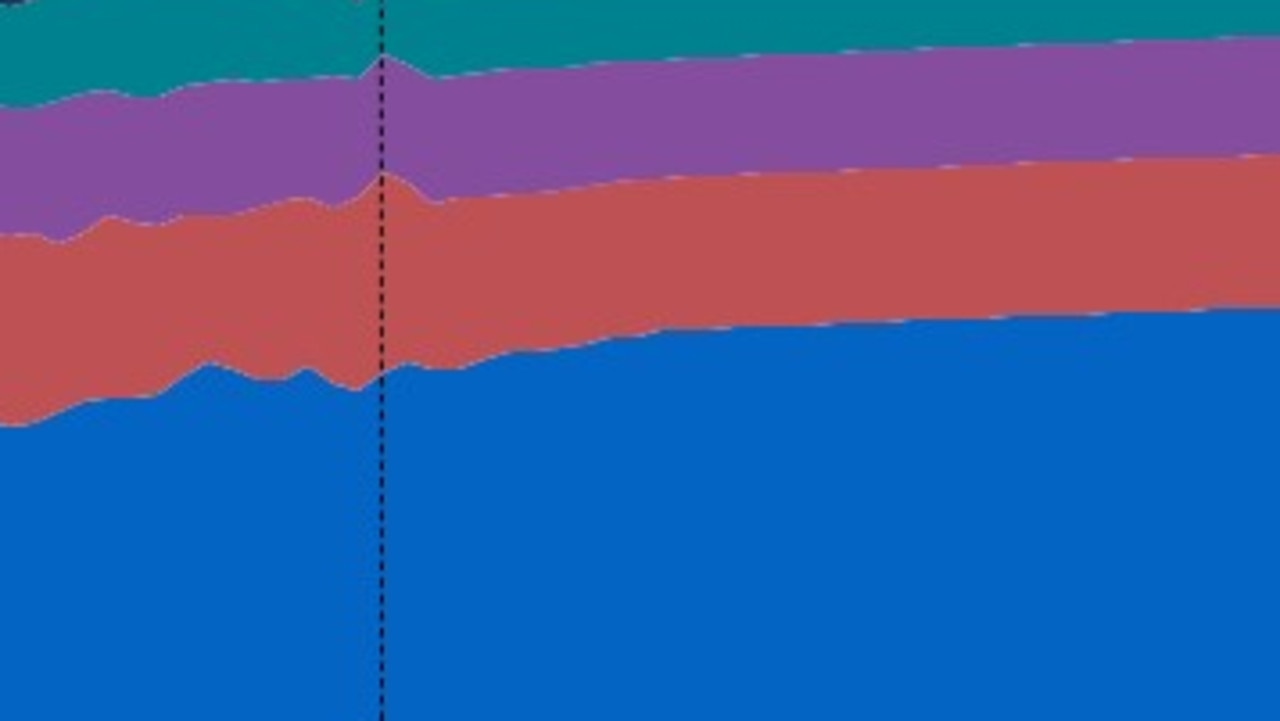

The report forecast that the personal income tax receipts will soar to more than 58 per cent of the overall tax take unless “policy change” occurs. Personal income tax receipts are currently worth 50.5 per cent of the overall federal tax base.

Asked earlier on RN Breakfast whether it was fair for young Australians to shoulder a greater tax burden, Dr Chalmers said none of the trends identified in the report were a certainty.

“None of this is preordained, none of this is predetermined and we have choices and governments will have choices over the course of the next 40 years to change course if they want to,” he said.