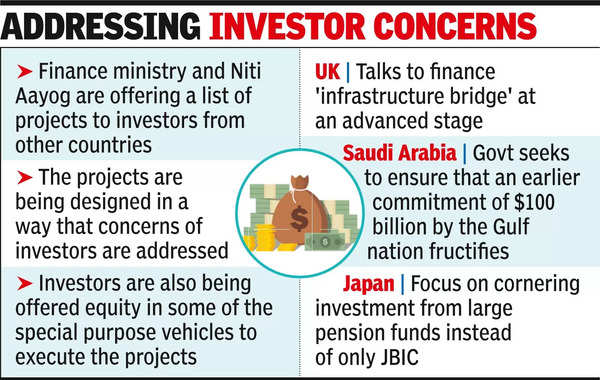

Unlike the past when only broad commitments were taken, this time, the finance ministry and Niti Aayog are offering a list of projects, such as a ring road around a tier II city or a large highway, to investors from other countries.

Besides, the projects are sought to be designed in a way that the concerns of the investors are addressed, and they are also being offered equity in some of the special purpose vehicles to execute the projects, sources told TOI.

While an “infrastructure bridge” with the UK is at an advanced stage, talks with Saudi Arabia are seeking to ensure that an earlier commitment of $100 billion made by the oil-rich kingdom actually begins to flow as there has not even been a trickle from the Gulf nation. The response from Saudi authorities has not been so positive so far.

Similarly, in the case of Japan, the pitch is to corner investment from the large pension funds in the Asian giant instead of merely depending on JBIC, which finances projects with several conditions.

The funding sources are in addition to traditional long-duration funds that govt has been eyeing from Canada, Australia and other parts of the world.

While there are concerns around investor protection and certainty of investment, govt is seeking to address some of them through existing mechanisms, the sources said. Besides, some of the investors from the UK had raised environmental issues, including in road projects, which were addressed by the National Highways Authority of India (NHAI) as ESG is part of the mandate for most assignments. Govt is looking to channelise resources from multiple sources to ensure that infrastructure construction takes place in full swing as it is seen to be crucial for economic growth.

A bulk of the resources are flowing into transport – highways and railways – with even the public spending of Rs 11,11,111 crore focused on these two crucial sectors. Green energy is another thrust for govt although there is significant private investment too that is flowing into the sector. Even in the Budget, FM Nirmala Sitharaman is expected to prioritise infrastructure investment as it is seen to help generate demand for steel, cement and other inputs while creating jobs.