The two cases are seen to be due to the fault of the exporter, who told authorities that the scheme was an “incentive”, something that the government has dismissed. Officials told TOI that the scheme put in place three years ago is simply to refund the taxes and levies that exporters pay and is completely in line with the global practice of shipping goods without duties. It had replaced Merchandise Exports from India Scheme (MEIS), which was found to be non-compliant with the World Trade Organization (WTO) regime.

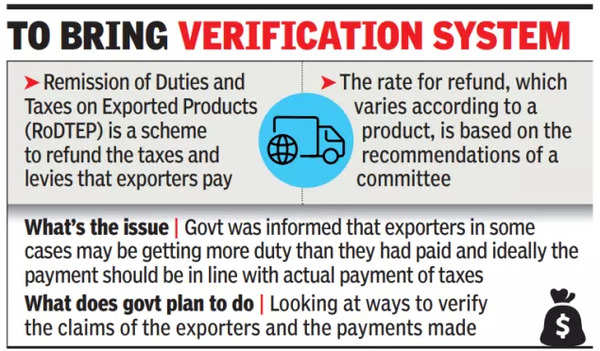

The rate for refund, which varies according to a product, is based on the recommendations of a committee and the same payment is made to all beneficiaries.

During their exchange with European and American authorities, the Indian government has been told that exporters in some cases may be getting more duty than they would have paid and ideally the payment should be in line with the actual payment of taxes. As a result, the government is discussing ways to verify the claims of the exporters and the payments made, while it is acutely aware of the need to ensure that the system does not turn into an exercise that puts burden on businesses and makes life difficult.

Separately, officials have ruled out the introduction of a similar scheme for services, at least immediately, something that was discussed when RoDTEP was announced by government. The scheme would have replaced Service Exports from India Scheme, which was deemed WTO-compliant.

In addition, government’s assessment was that the benefit was cornered by a handful of service providers, such as large consulting firms, which outsource work to India. There were several other misuses that were reported by service providers, which prompted the commerce department to work on a plan that ensures a fool proof system.

Officials, however, said that given the nature of the services business, especially where overseas outfits of the same company or related parties are involved, it may be tough to administer it.