The decision was made due to the possibility that old mobile numbers could be issued to new users, leading to inadvertent transfers. The new guidelines require Third Party App Providers (TPAP) and Payment Service Providers (PSP) to take action by December 31, 2023.

- TPAPs and PSP banks must identify UPI IDs and associated UPI numbers and phone numbers of customers who have not conducted any financial or non-financial transactions for a year through UPI apps.

- The UPI IDs and UPI numbers of such customers will be disabled for inward credit transactions, and the same phone numbers will be deregistered from the UPI mapper.

- Customers with blocked UPI IDs and phone numbers for inward credit transactions must re-register in their UPI apps for UPI mapper linkage. They can continue making payments and non-financial transactions using their UPI PIN as required.

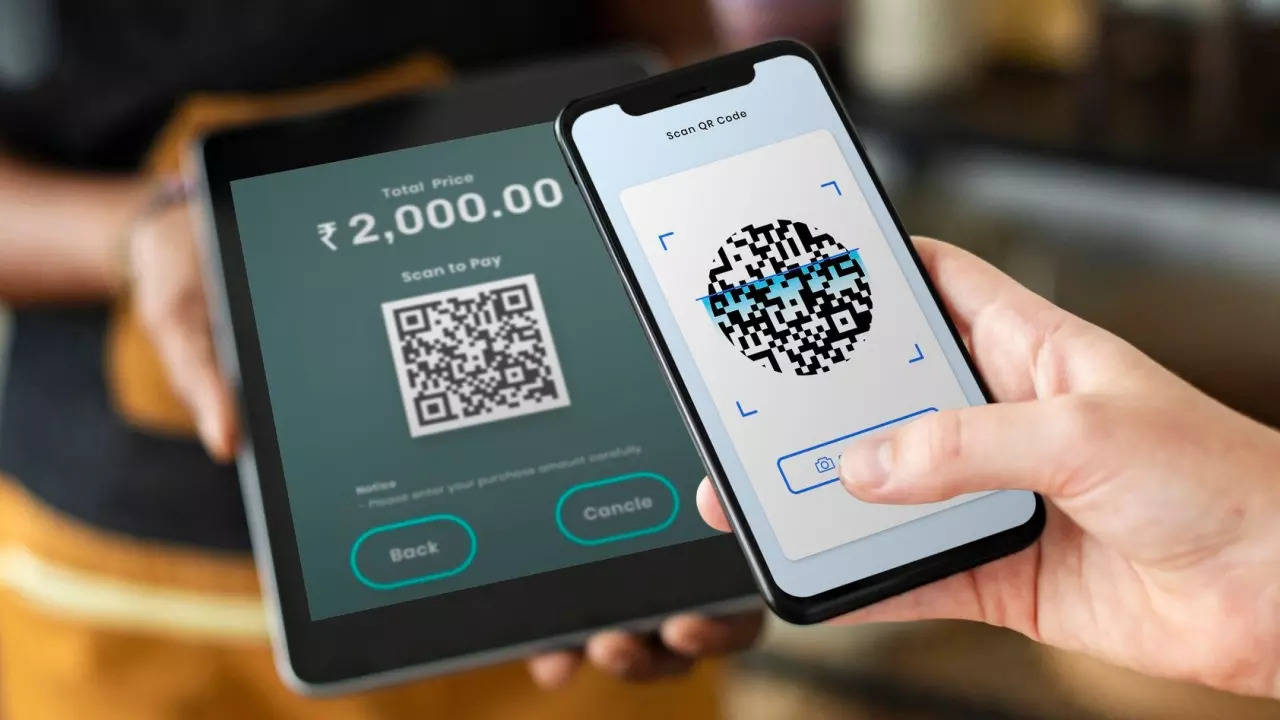

Additionally, UPI apps are required to perform Requester Validation (ReqValAd) before initiating ‘Pay-to-contact’ and ‘pay to mobile number’ transactions. The apps must display the customer name that has been fetched before initiating the transaction and should not display the name stored at the app’s end.

UPI Transactions & RuPay Cards: What’s The Next Milestone for India’s Digital Payments Revolution?

This initiative aims to ensure a safe and secure transactional experience for users. The NPCI circular emphasizes the importance of customers regularly reviewing and verifying their information within the banking system to ensure this. It has been observed that customers sometimes change to new mobile numbers without disassociating their previous numbers from the banking system.