A simple calculation has revealed the reality that many Australians can’t borrow as much as they are expected to pay in rent.

Aussies have always been told that everyone will be given a fair go if they put in the effort, but when it comes to the great Australian dream of owning a house, this just isn’t true anymore.

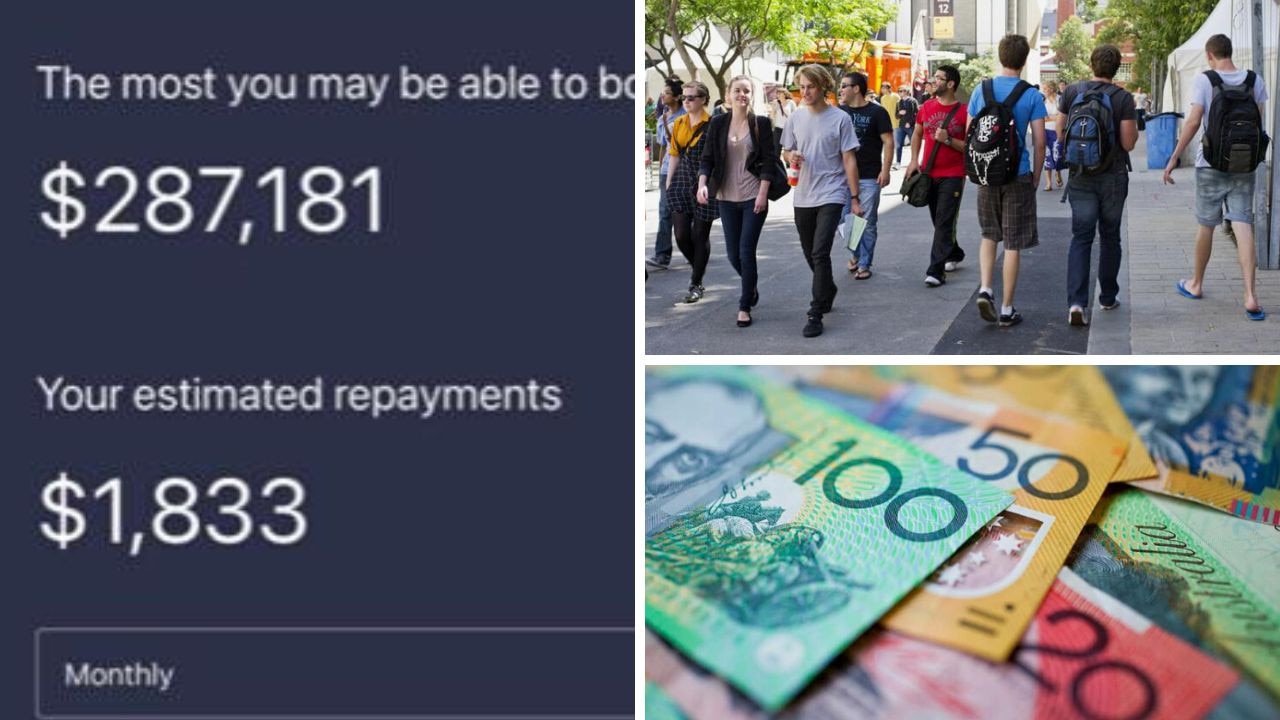

A post in a group aimed at Aussies sharing their plights during the rental crisis has accrued hundreds of comments after a man revealed that he used a bank’s home loan calculator and was shocked to discover that the most he could borrow was $287,181.

The man decided to put his and his partner’s household income into the calculator after seeing an ad for five per cent deposit home loans.

“After putting in mine and my partner’s income I was told I apparently can only afford $1800 a month in repayments, my rent is $3400 monthly,” he said

The post kicked off a huge conversation about how so many Aussies are paying vast amounts in rent and therefore unable save up for a deposit, which is creating a vicious cycle.

“Good thing only mortgage stress exists. How else are landlords going to afford to buy their 158th property if the renters leave the rental market?” one person fumed.

“The numbers just do not add up,” another shared.

“Where is someone going to buy a property for $287,000?” another asked.

“I laughed at this post because it is so ridiculous! Most of us could probably afford a mortgage, but the lenders think we can’t because we rent,” one said.

One commentator declared it was “disgusting” before pointing out how the numbers didn’t reflect the reality.

“Your rent per month is almost double the mortgage payments, meaning your home loan will be paid off in almost half the loan life,” they wrote.

Another shared they’d been renting for over two decades and had paid $500,000 in rent over that period but were unable to get their feet in the buying door.

“Paid off a few landlord’s mortgages, but I can’t get a mortgage,” they shared.

Financial expert Julian Finch said that the reason the calculations seem odd is because real estate agents don’t need to consider what Australians can realistically afford where as banks need too.

“Real estate agents don’t care what you can afford, and they’ll just say okay if you’re the best candidate,” Mr Finch said.

He pointed out that you should only see the calculations as a guide and not to take them too seriously.

“Those calculators use lots of assumptions and I’d suggest lots of people don’t put the right numbers in. They should be seen as a reference and not as a rule,” he advised.

Mr Finch said that there is a reason why people can’t borrow the amount that equals the same amount in repayments as they pay in rent.

“When you apply for a home loan, say your interest rate is 6 per cent, but that bank calculates what you can afford on 9 per cent, so there’s a 3 per cent buffer,” he explained.

Plus, Mr Finch advised that banks will look at how much you’re spending as a household and only sometimes consider bonuses and overtime as guaranteed income.

However, he did say that isn’t a reason to give up the hope of getting away from renting and purchasing a home.

“A lot of banks will take your rental history and allocate that to your genuine savings,” he said.

Mr Finch said, ultimately, while the calculators can be a helpful tool to give people a sense of what they can borrow, he would advise trusting it only partially.

“They’re a guide, and they aren’t a true indicator,” he said.

New research from the Parliamentary Library, commissioned by the Greens, revealed Aussie tenants are paying on average a house deposit every five years in rent.

Data complied from the Australian Bureau of Statistics estimated the average renter had paid $106,550 per household over the period. Over 10 years, the data indicated a household had paid $209,908 in rent.

But the library warned the data relied on a number of very broad assumptions, including an average rent of $401 per week paid.

“They do not reflect any particular individual circumstances,” it said.

It is no secret that it is a tough time for Aussie renters and, according to Proptrack, rents in most capital cities in Australia have risen drastically in 2023.

The only cities where rent has yet to go up across the board are Hobart and Canberra, but every other city has seen a considerable increase.

Rent in Sydney has risen by 18 per cent, followed by rent in Melbourne, which has increased by 14 per cent. Rental prices in Brisbane have ballooned by 12 per cent. An overall 11 per cent increase has hit renters in Adelaide, prices in Perth have jumped by 15 per cent and rent in Darwin has increased by 4 per cent.

Not to mention that the cost of living crisis has led to inflation hitting 7 per cent, and wage growth has only risen by 3.8 per cent in 2023.