The reason: the Hyderabad-based contract development and manufacturing organisation (CDMO) was their largest supplier of active pharmaceutical ingredients (APIs) for drugs such as naproxen (osteoarthritis), dextromethorphan (cough suppressant), gabapentin (anti-depressant) and levetiracetam (epilepsy).

USFDA granted exemptions and the import alert was lifted in just six months, perhaps the shortest ever for any company. This was a defining moment in the entrepreneurial journey of Dr Murali Krishna Prasad Divi, founder & managing director of Divi’s Labs.

MASTERING CHEMISTRY

Divi says, “We mastered the chemistry to an extent that it’s very difficult for others to enter into our products.”

Today, Divi’s Lab is among the top three API manufacturers globally. This success has catapulted Dr Divi, who hails from an agrarian family from sleepy Machilipatnam in Andhra Pradesh, onto the global rich list. During Covid-19, his wealth peaked to around ₹75,000 crore in October 2021 after the Divi’s Labs scrip hit its all-time high of ₹5,425 per share, driven largely by the one-time opportunity in anti-viral drug Molnupiravir.

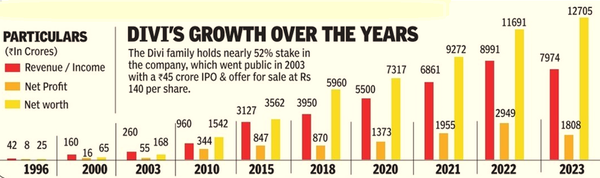

The Divi family holds nearly 52% stake in the company, which went public in 2003 with a ₹45 crore IPO & offer for sale at ₹140 per share.

But this success did not come without its dose of failure. Not only did Dr Divi flunk his 12th exam, he also failed to clear his first year BPharm exam.

Having tasted failure, he aced his BPharm with distinction, followed by MPharm and joined Warner Hindustan as a trainee in 1975.

Soon he got an opportunity to work with Uniloids, the maiden entrepreneurial venture of Dr Kallam Anji Reddy, who quit Indian Drugs & Pharmaceuticals Ltd to turn entrepreneur. Soon a restless Dr Divi decided to head to the US to try his luck with just $7 in his pocket. “In those days that was all the foreign exchange you could carry abroad,” he says.

NO PLACE LIKE HOME

A family emergency in 1983 and homesickness brought Dr Divi back to Hyderabad. Armed with experience in pharma and fine chemicals, he met Dr Anji Reddy again, who had by then floated Standard Organics, where he worked briefly as GM R&D.

Soon he got an opportunity to partner Dr Reddy in acquiring Cheminor Drugs, a sick API manufacturer, in 1984, the year that Dr Reddy’s Labs was also founded.

As co-promoter & MD, Dr Divi steered Cheminor, which became India’s first API unit to get USFDA approval for pain drug Ibuprofen and later antacid Ranitidine but decided to strike out on his own in 1990 with Divi’s Research Centre Pvt Ltd, providing technology and consulting to other pharma companies.

His big bet came in 1994, when he invested around ₹7 crore of savings in setting up a greenfield API plant in Nalgonda for ₹71 crore and rechristened it Divi’s Laboratories.

“I borrowed only when I started the company. I borrowed ₹35 crore from IDBI in 1995, paid it back in nearly five years. We also stopped working capital borrowings since 2010.”

HIS SUCCESS MANTRA?

He stuck to the basics and what he knew best chemistry – to churn out APIs for the big daddies of global pharma.

“From the very beginning we decided to not get into litigation with big pharma. We never violate patents and we don’t compete with our customers. We play a complementary role to innovator customers and play non-compete with generic customers,” he points out.

“Customers are gods. Gods don’t bargain. We work with eight of the top 10 pharma companies in the world,” adds his son Kiran S Divi, CEO & whole-time director at Divi’s Labs.

Today, Divi’s Labs is a debt-free company sitting pretty on about ₹4,000 crore cash, adds his daughter & whole-time director (commercial) Nilima S Divi.

Divi’s Labs is now making a play for emerging opportunities using green chemistry principles, including peptides, especially GLP-1 (glutides) that are being used for tackling obesity and present the next blockbuster opportunity for big pharma.