Indirect retail participation in equities has also seen a stellar rise in a decade as the number of mutual fund folios has grown from less than 3 crore in March 2014 to over 11 crore as of Dec 2023. Retail investors, including high networth individuals, account for 91% of the Indian fund industry’s nearly Rs 22-lakh-crore equity assets under management.

“In the past decade, mutual fund equity AUM demonstrated an impressive 30% CAGR. Moreover, monthly SIPs surged from a modest Rs 1,200 crore in 2014 to over Rs 19,000 crore in 2024. This remarkable growth in equity mutual funds reflects the substantial surge in equity investing culture among Indian investors,” said Radhika Gupta, MD and CEO, Edelweiss MF.

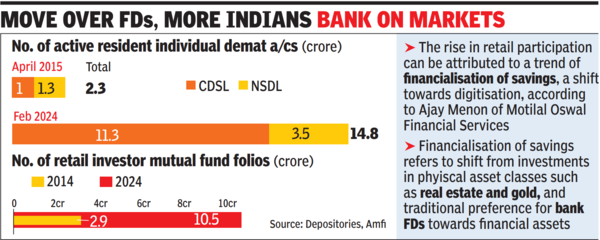

The SIP-driven rise of individual investors has provided mutual fund companies with ammunition, which they have deployed effectively amid bouts of foreign fund selloffs. Essentially, retail investors have emerged as a counterbalance to deep-pocketed foreign fund managers. “The resilience in the Indian market is driven by vibrant participation from the domestic retail segment. The continued rise in retail participation can be attributed to an ongoing trend of financialisation of savings, a shift towards digitisation, and ease of doing investment with mobile platforms & UPI,” said Ajay Menon, MD & CEO (broking & distribution), Motilal Oswal Financial Services.

While India added over 12 crore demat accounts in a decade – which is roughly the population of Japan – the share of retail stock market investors at around 10% of the population pales when compared to the nearly 60% share in the US.