Bharti has already acquired 9.9% in the UK’s top fixed and mobile communications provider through a market deal.Based on BT’s current market value, the entire transaction — which is subject to regulatory approvals, including security clearance — is estimated around $4 billion.

The deal adds to the list of marquee British companies and brands acquired by Indian entities, including Jaguar Land Rover, Corus and Tetley by Tata, apart from BSA by Mahindra Group and Hamleys by Reliance Brands.

“BT to my mind has a much brighter future ahead and they need to be following their strategy, if I may say, even more boldly… We are not in this for making a buck or looking at stock markets up or down. We are long-term telecom investors,” Bharti Enterprises chairman Sunil Bharti Mittal said during a call, adding that the investment offered synergies. Flanked by his son Shravin, Bharti Global MD, he pitched it as a strategic deal which was in line with strengthening India-UK ties and offered opportunities on AI, 5G RD and core engineering.

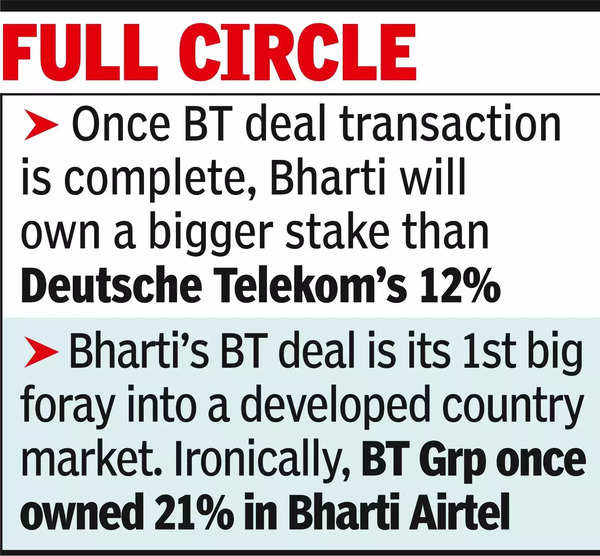

Once the transaction is completed, Bharti will own more stake than Deutsche Telekom’s 12%. The deal follows Mexican magnate Carlos Slim’s 3.2% acquisition in BT two months ago.

Despite slower growth opportunities, it marks Bharti’s big foray into a developed country market with the group having so far focused on Africa, Bangladesh, Sri Lanka and Seychelles in addition to the home market. “Growth in Europe and the UK is bound to be much… So, growth is very small, 1-2% a year… But the revenue is pretty large, $25 billion of current revenues, and $10 billion in EBITDA… can we create more efficiency, can the free cash flows increase over a period of time…,” he said.

Mittal said that his group zeroed in on BT from other options that were on the table and indicated that it may opt for more acquisitions in future.

“We got this opportunity to buy a very important block of shares. It is very difficult to buy such stock in the market. It takes a long time and there are uncertainties of pricing… here was a block with a willing seller who moved in to make this offer and we quickly decided to take the same,” he said.

Mittal said that the stability in the Indian business in recent months, which came after some large investments and intense competition, had given the group “the courage to look at the opportunity” and the Indian operations will not be impacted in any way by the investment. BT and British authorities welcomed the transaction as did Indian authorities.

“…the wheel has come full circle since 1997 when British Telecom acquired a 21% stake in Bharti Airtel. This acquisition is testimony to the growing strength of India as we march towards Viksit Bharat under the inspirational leadership of PM Modi ji. We thank UK Prime Minister @Keir_Starmer and Foreign Secretary @DavidLammy for their continued support in strengthening business ties between the two countries,” commerce & industry minister tweeted.

In the past, stake acquisition in companies such as BT has attracted security concerns in the UK and Goyal’s tweet suggested that the British govt may be on board.

By Mittal’s own admission, the transaction marks a departure from his usual style of being “an operator”. Instead, his group is not seeking a board seat, at least for the moment. “We see this as a positive step for BT. We have a long and good working relationship with Bharti. So, we are looking forward to work together with Bharti on the board of directors for the sake of BT shareholders and customers,” Deutsche Telekom CEO Timotheus Höttges said.