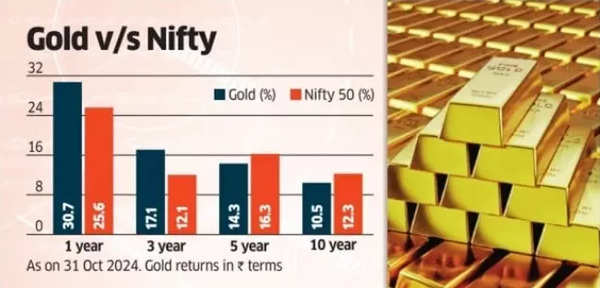

Gold bull run nearing end? Gold’s performance has surpassed the Nifty 50 index in the past year, with a 30.69% increase in rupee terms and 39.10% in dollar terms, compared to Nifty 50’s 25.6% growth. In 2024, gold appreciated by 26% in rupee terms, while Nifty gained 11.8%. So is this the best time to buy gold? Should you increase your asset allocation towards gold?

Gold has outperformed the broader Nifty 50 index over the past year, yet wealth managers caution that its growth may slow in the near term. They advise investors to avoid overcommitting to gold and to maintain a balanced asset allocation.

Financial advisors recommend maintaining existing asset allocation rather than increasing exposure to gold, as its current bull run may be approaching its end. The suggested portfolio distribution remains at 10% in gold, 30-40% in fixed income, and 50-60% in equities, according to an ET report.

Gold vs Nifty

“Gold has had a sharp run-up in the recent past and incremental gains look limited in the near term,” said Manav Modi, bullion analyst at Motilal Oswal Financial Services.

Modi suggests investors should make staggered purchases during gold price dips, targeting Rs 81,000 to Rs 86,000 per 10 gram over the next two years.

Also Read | PM Modi highlights Mark Mobius’ ‘love for India’; says renowned global investor believes 50% should be invested in Indian stock market

Analysts note gold’s historical strong performance during US election periods, with current circumstances intensified by global factors.

Central banks are increasing their gold reserves to reduce US dollar dependence, while investors seek safety amid West Asia tensions and Iran-Israel conflicts.

“There are no economic parameters one can use to predict returns in gold,” said Vineet Nanda, founder of SIFT Capital. “Investors should buy gold as a hedge against inflation and not go overboard on it.”

Also Read | Top 5 Bank Fixed Deposits: Which are the best FDs for 1, 2, 3 and 5-year time period? Check list