Govt sources said the judgement’s impact on the sector and its investment prospects as well as policy issues will be studied to decide the way forward.

Official estimates put the arrears for the public sector entities at Rs 70,000-80,000 crore as the court has not allowed interest. State-run steelmaker SAIL alone will face an outstanding of Rs 3,000 crore. Mining industry bodies, however, saw the total outstanding rising up to Rs 2 lakh crore.

NMDC chairman Amitava Mukherjee said the judgement will impact the mining industry at large and the company was evaluating both short- and long-term implications.

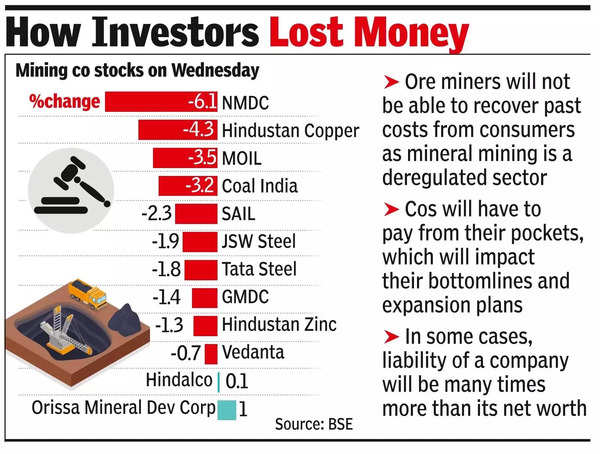

Since mineral mining is a deregulated sector, ore miners will not be able to recover past costs from their consumers and will have to pay from their pockets, which will dent their bottomlines and financial strengths for expansions. In some cases, as enumerated in govt’s submission during the hearing, the liability of a company will be several times more than its net worth.

The judgement has the potential to push up power tariffs as generation companies will pass on to consumers the past costs claimed by coal miners under the “change in law” provision of the cost recovery mechanism in the power purchase agreements, a binding contract. Industry executives, however, expected a rash of litigations from utilities challenging the cost recovery by generators.

Among private players, Tata Steel saw an impact of Rs 17,347 crore, which it has listed as contingent liability. Vedanta said it has no material demands raised upon any of its businesses at present. “If and when any such demands are raised, Vedanta will consider all regulatory and legal remedial measures on a case-to-case basis.”

The arrears will pinch state-run Coal India harder, which is witnessing shrinking margins and headroom for competitive pricing in the face of large-scale private entry due to higher overheads from legacy mines and manpower. This will negatively impact modernisation and expansion.