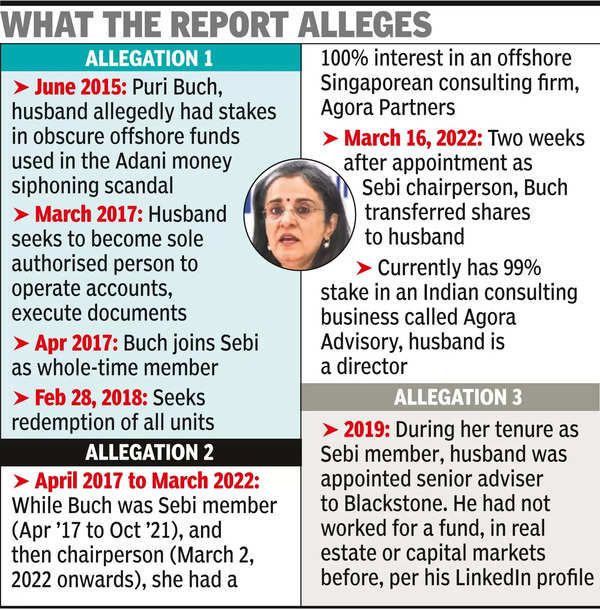

Sebi chief and her husband, through 360 One WAM (IIFL’s wealth management arm), had allegedly invested in Global Dynamic Opportunities Fund, the same fund that Vinod Adani, elder brother of Gautam Adani, had used to invest in Adani group’s stocks, Hindenburg said.The Adani group has refuted all of Hindenburg’s allegations.

The report that was released late Saturday evening alleged that Sebi’s “drew a blank” in its probe against Adani due to the alleged investments by Buch and her husband in the offshore funds. In March 2017, before Buch was appointed Sebi member, Dhaval wrote to the Mauritius fund administrator informing that he would become the sole person to operate the account. Subsequently, in Feb 2018, after joining Sebi, Buch purportedly sought to redeem all the units held with the Fund, Hindenburg said. A Sebi spokesperson did not respond to a request for comment, while a spokesperson for 360 One WAM declined comment.

Not much ‘substance’ in Hindenburg report, say market veterans

Hindenburg’s latest report also pointed out that between April 2017 and March 2022, when Buch was a whole-time member at Sebi and then its chief, she allegedly had a 100% interest in an offshore Singaporean consulting firm called Agora Partners. On March 16, 2022, two weeks after her appointment as Sebi chairperson, she “quietly transferred the shares to her husband”, the report alleged.

“This offshore Singaporean entity is exempt from disclosing financial statements so it is unclear the amount of revenue it derives from its consulting business and from whom — crucial information for those assessing the probity of the chairperson’s external businesses interests.”

But she allegedly continued to retain 99% stake in Agora Advisory Pvt Ltd, an Indian consulting firm, where her husband is a director. In 2022, it reported revenues of $261 million (around Rs 2,000 crore)

“Conclusion: Conflict or capture? Either way, we do not think Sebi can be trusted as an objective arbiter in the Adani matter,” Hindenburg said, while calling for further probe.

The report also mentions that while Buch was a whole-time member at Sebi, her husband was appointed a senior adviser to Blackstone in 2019. “He had not worked for a fund, in real estate or capital markets before, as per his LinkedIn profile,” it said, while alleging a conflict of interest.

On its part, on June 27 this year Sebi had issued a showcause notice to Hindenburg, alleging deficient disclosures about their short positions in Adani stocks.

Using whistleblower documents, Hindenburg on Saturday said that Buch and her husband Dhaval first appeared to have opened their joint account with one offshore fund on June 5, 2015, in Singapore. “A declaration of funds, signed by a principal at IIFL states that the source of the investment is ‘salary’ and the couple’s net worth is estimated at $10 million,” the report said.

Hindenburg said that after it released its initial report against Adani group that within five weeks wiped off about 65% of the group’s market value it was surprised by the regulator’s actions that failed to find faults with the ports-to-FMCG group. “What we hadn’t realised: the current Sebi chairperson and her husband had hidden stakes in the exact same obscure offshore Bermuda and Mauritius funds, found in the same complex nested structure, used by Vinod Adani,” it said.

“We suspect Sebi’s unwillingness to take meaningful action against suspect offshore shareholders in the Adani Group may stem from (Sebi) chairperson Madhabi Buch’s complicity in using the exact same funds used by Vinod Adani, brother of Gautam Adani.”

Following the controversy that erupted post the Hindenburg report was published, Sebi started its own investigations into the allegations. At the same time, despite pressure from the opposition at Parliament, the govt declined to refer the case to a joint parliamentary committee (JPC). But a suit in the Supreme Court was filed which directed Sebi to investigate under its directions.

Later in 2023, the Supreme Court had said that Sebi had “drawn a blank” in its investigations into who funded Adani’s offshore shareholders. “If Sebi really wanted to find the offshore fund holders, perhaps the Sebi chairperson could have started by looking in the mirror,” Hindenburg’s latest report said. “We find it unsurprising that Sebi was reluctant to follow a trail that may have led to its own chairperson.”

Market veterans, fund managers and institutional traders TOI spoke to, however, said that although optically the report was highly damaging to Sebi and its chief, there was not much ‘substance’ in it. Indians who open offshore accounts use IIFL’s vehicles which mostly invest in a segregated manner. “Those vehicles aren’t commingled,” said an offshore trader.