The comment by IBBI chairman Ravi Mittal in the latest newsletter comes months after a Supreme Court ruling.”The judgment has cleared roadblocks for the insolvencies involving PGs, providing relief for lenders whose petitions for insolvency proceedings against PGs were getting stuck in various legal forums due to challenge of various provisions. This facilitates a more holistic resolution of the corporate debtor (company) and its PGs aligning with the IBC’s mandate for value maximisation,” he said.

List of PGs facing proceedings includes several well-known names – from Anil Ambani to Venugopal Dhoot, Ruias of Essar Group and Bhushans of Bhushan Steel. At the height of the loan boom, when valuations had soared, personal guarantees were the norm.

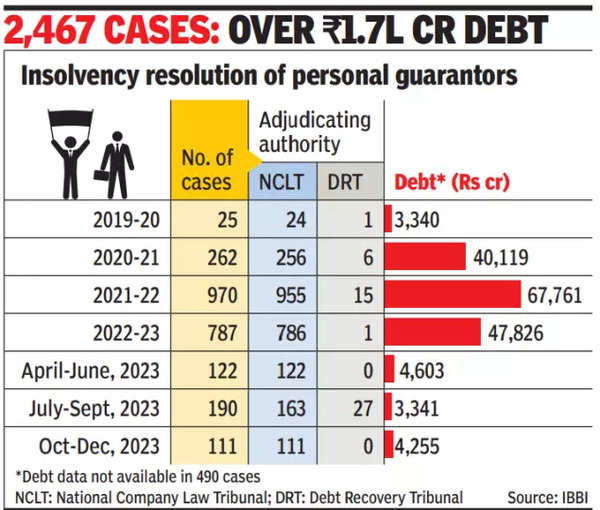

At the end of Dec, there were nearly 2,500 such insolvency applications, involving debt of over Rs 1.7 lakh crore Of these, 87 applications have been withdrawn or rejected before the appointment of a resolution professional (RP), while RPs have been appointed in 1,096 cases. After appointment of a RP, 296 cases have been admitted in NCLT. So far, only 21 cases have resulted in approval of a repayment plan, with the amount realised adding up to just Rs 91 crore – or 5.2% of the claims.

IBBI data showed creditors have been able to recover around 32% of claims admitted by NCLT. Cases have dragged for 724 days, 2.7 times of deadline of 270 days.

Mittal pointed to “excessing litigation” delaying cases, which results in value erosion of the company and in turn increases the burden on the guarantors. Citing IBC, he argued that process for PGs prioritises debt restructuring over outright bankruptcy, which is the last resort in case the repayment plan falters. “By cooperating in the process and submitting a repayment plan for approval by creditors, debtors can effectively discharge their debt liabilities instead of initiation of their bankruptcy process,” Mittal wrote in a message to PGs.