A recent analysis conducted by VIDEC under the title “India Ground Transportation Market Sizing & OTA Benchmarking Study, FY20-FY26″ has unveiled the notable developments within the travel market. The report segments the total market into online and offline channels and estimates OTA GBV using a demand-side, top-down approach for each category.

According to the India Ground Transportation Market Sizing & OTA Benchmarking Study, the transformation in the ground category in the last decade or so has been a result of the emphasis on building massive hard infrastructure (tracks, trains, and highways) along with a robust soft infrastructure (digital and technology stack). While investment in technology is one aspect of this turnaround story, the other is the focus on human capital and customer satisfaction.

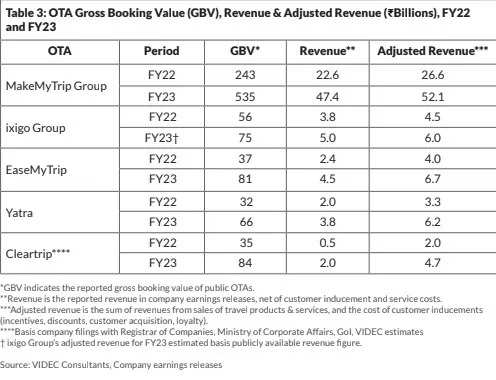

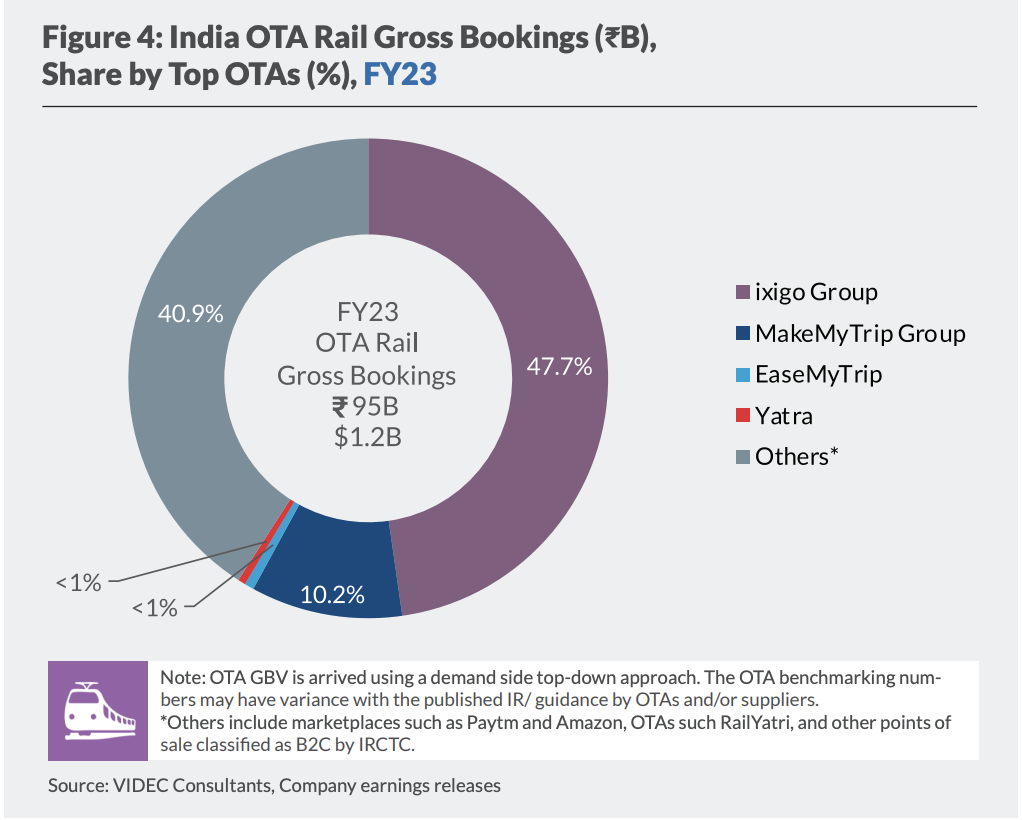

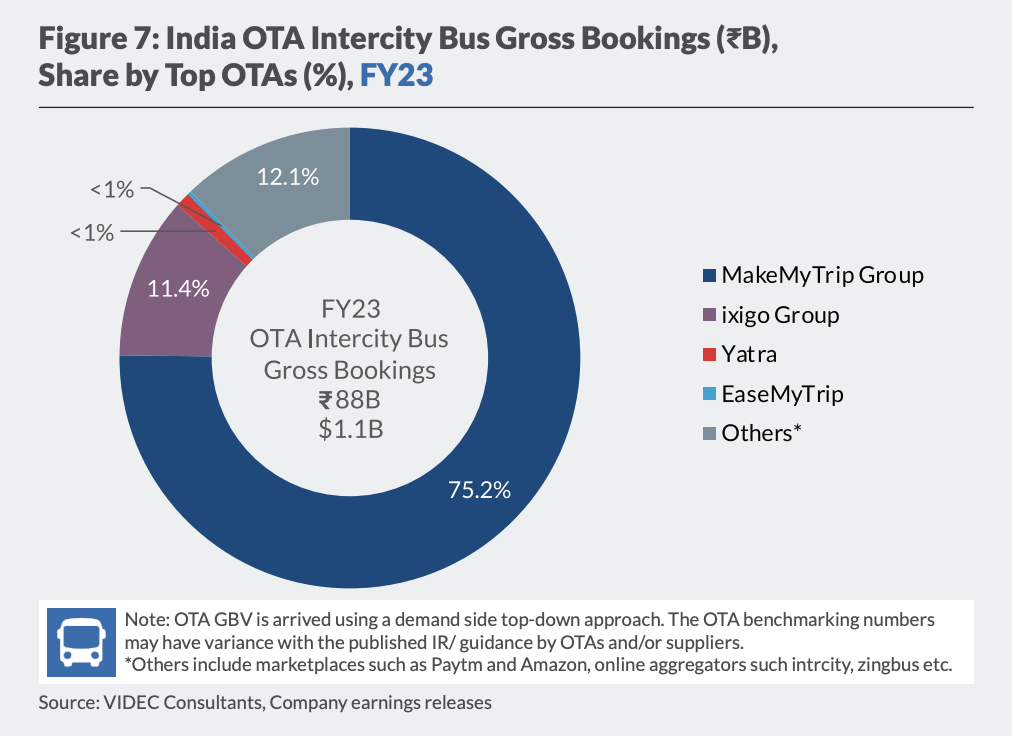

The findings have highlighted MakeMyTrip Group as the largest online travel agency (OTA) by revenue in India for both fiscal years 2022 and 2023 followed by ixigo Group, which includes subsidiaries ConfirmTkt and Abhibus, as the second-largest OTA. EaseMyTrip, Yatra and Cleartrip take third, fourth and fifth spot.

The intercity bus market in India is about 85 per cent of the rail category (INR 617 billion) in FY23. However, it’s highly under-penetrated at 19 per cent compared to rail at 82 per cent.

MakeMyTrip Group, which owns redBus, has a commanding share of 75 per cent in the OTA intercity bus market in FY23. leader. ixigo Group, though a distant second, is catching up in the intercity bus category through its subsidiary AbhiBus. In rail, B2C channels (OTAs, ecommerce marketplaces and other indirect points of sale) cornered roughly one-fourth of the online rail GBV in the same period. ixigo Group, including its subsidiary ConfirmTkt, leads the B2C rail GBV with nearly 50 per cent market share. Ecommerce marketplaces such as Paytm and Amazon, and OTAs such as MakeMyTrip Group and RailYatri cumulatively make up for the rest of the B2C rail GBV.

VIDEC’s latest research underscored the enduring prominence of Indian Railways as the country’s foremost mode of transportation, boasting a substantial market size of nearly INR 617 billion (USD 7.7 billion). The Indian rail market reached its life-time high GBV of INR 617 billion (USD 7.7 billion) in FY23, up 63 per cent from INR 378 billion (USD 5.1 billion) in FY22. It is projected to rise to INR 801 billion (USD 10 billion) by FY26, growing at a CAGR of 9 per cent during FY23-FY26.

Notably, the online B2C channel for rail bookings is anticipated to witness a remarkable 23 per cent Compound Annual Growth Rate (CAGR), surging from INR 95 billion in fiscal year 2023 to a projected INR 176 billion (USD 2.2 billion) by fiscal year 2026, thereby constituting a noteworthy 26 per cent of the overall rail bookings market.

Additionally, the study foresees rapid expansion within the bus travel segment and is going to be the cornerstone of growth in the Indian online travel market. The report notes that while the aggregate online travel market is projected to grow at 18 per cent CAGR in the period from FY23-FY26, the CAGR for online intercity bus market will be 21 per cent.

The study further highlights that the overall Gross Booking Value (GBV) for the intercity bus market reached approximately INR 539 billion in fiscal year 2023, with the online intercity bus segment accounting for a GBV of INR 100 billion (USD 1.2 billion) during the same period.

This represents a significant growth trajectory, with online adoption in the intercity bus sector climbing to 19 per cent in fiscal year 2023 and projected to further escalate to 26 per cent of the total market by fiscal year 2026.

“The ground transportation category offers the two extremes of the Indian online travel market. Rail is the highest penetrated category at 82 per cent, while intercity bus is the most underpenetrated category at 19 per cent in FY23, with a long runway for a sustained growth. The OTA intercity bus market GBV is projected to increase at 21 per cent CAGR in FY23-FY26 to reach ₹153 billion. OTAs are commanding a lion’s share (nearly 90 per cent) of the online intercity bus GBV and they will continue to drive the online adoption and lead the category,” said Virendra Jain, Co-founder and CEO, VIDEC.

Co-founders of ixigo, Rajnish Kumar and Aloke Bajpai said that by addressing pain points specific to Tier 2 and Tier 3 users through rail-centric use cases and augmenting their strengths in ground transportation via acquisitions like ConfirmTkt and Abhibus, ixigo is not only enhancing its position in the market but also cross-selling and up-selling additional services such as flights and hotels to this rapidly expanding segment.

The report highlights the importance of cost of customer acquisition and customer lifetime value as critical metrics for OTAs, and notes that the ground category—rail and intercity bus—offers high booking volumes at lower acquisition costs. The report also emphasises the prowess of OTAs in offering a buffet of personalised products in the age of instant gratification and gamification and notes that OTAs have succeeded in attaching fintech products.