RBI had imposed the restrictions due to a lack of transparency and disclosure of conditions like fees, charges, and recovery practices in a key fact statement, which is a crucial requirement for digital loans.

The EMI card allows customers to shop with a flexible repayment tenure for purchases of consumer goods and electronics without an additional cost. Similarly, the eCOM product enables online purchases on platforms such as Amazon and Flipkart through loans.

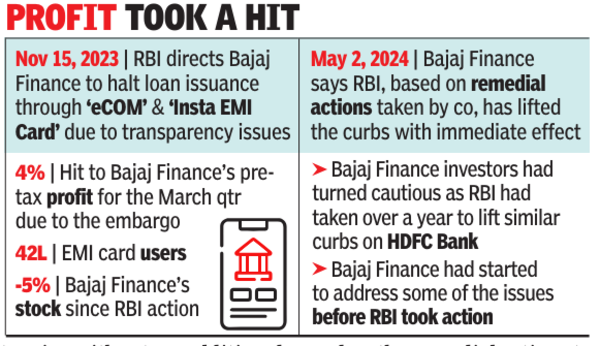

Bajaj Finance informed the stock exchanges that RBI, based on the remedial actions taken by the company, has lifted the restrictions with immediate effect. The company will resume sanction and disbursal of loans in the two segments.

RBI’s curbs had turned investors cautious as restrictions imposed on HDFC Bank in 2020 had lasted for over a year. Bajaj Finance, which had started to address some of the issues before RBI’s action, had recently requested the central bank to lift the ban.

Bajaj Finance had 42 lakh digitally sourced users for the EMI Card at the end of Sept 2023. RBI’s embargo had resulted in the company’s Q4FY24 profit before tax being hit by 4%. Last week, Bajaj Finance had reported a net profit of Rs 3,825 crore for the March quarter, an increase of 21% over the year-ago period. However, its stock fell 7% following the results on concerns over profit growth.