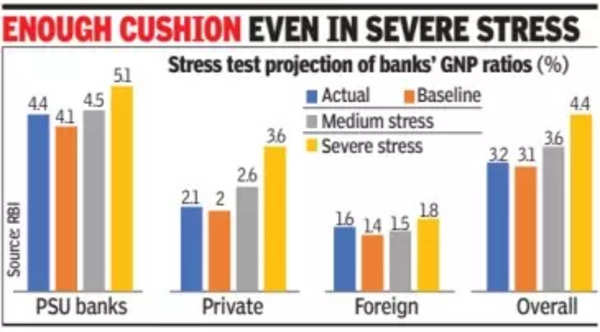

RBI has also revised the methodology for evaluating systemically important (too big to fail) banks and included the ‘total value of digital payments’ criterion.However, gross non-performing assets (GNPA) ratio of all scheduled commercial banks is projected to improve to 3.1% by September 2024 from 3.2%. The report said that if the macroeconomic environment worsens to a medium or a severe stress scenario, the ratio may rise to 3.6% and 4.4%, respectively.

Even if the GNPAs rise to the worst-case 4.4%, the banking system would be able to comply with minimum capital requirements, with the system-level CRAR (capital-to-risk weighted assets ratio) in September 2024 projected at 14.8%, 13.5% and 12.2%, respectively, under baseline, medium and severe stress scenarios.

“The health of the Indian financial system is steadily improving on the back of multi-year high earnings, low-level of stressed assets, and strong capital and liquidity buffers with financial institutions… Now is the time to consolidate these gains and enable the economy to move to a higher growth trajectory with macroeconomic and financial stability,” said RBI governor Shaktikanta Das in the report.

For SBI, the additional common equity tier-1 capital requirement has been raised to 80 basis points (100bps = 1 percentage point) above the prescribed level for banks, as opposed to 60bps.

Similarly, HDFC Bank’s additional capital requirement has been adjusted to 40bps from 20bps. Meanwhile, for ICICI Bank, identified as the third systemically important institution, the additional capital requirement remains at 20bps over the prescribed level.

The heightened domestic systemically important banks (D-SIB) surcharge for SBI and HDFC Bank will be effective from April 1, 2025. The update is based on March 31, 2023 data, accounting for the increased systemic importance of HDFC Bank following the merger with erstwhile HDFC on July 1, 2023. The report has also cautioned over the growing interconnectedness between banks and NBFCs through the funding route, highlighting the potential increase in contagion risk for banks due to idiosyncratic risks posed by various types of NBFCs.

“Stress in the NBFC sector has been assessed to be higher under a high-risk stress scenario relative to the March 2023 position. Contagion risks may warrant monitoring on account of increased inter-bank exposure,” the report said.