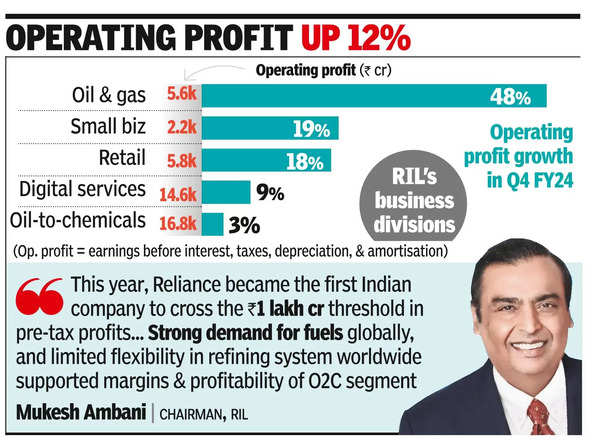

Operating profit, a yardstick for underlying business performance, increased about 12% to Rs 45,065 crore. Expenses climbed 11% to Rs 2.2 lakh crore. For the entire fiscal 2024, RIL‘s profit grew 7% to Rs 79,020 crore and revenue increased marginally by nearly 3% to Rs 9.1 lakh crore.

“It is heartening to note that all segments have posted robust financial and operating performance. This has helped the company achieve multiple milestones. I am happy to share that this year, Reliance became the first Indian company to cross the Rs 1-lakh-crore threshold in pre-tax profits,” said chairman and MD Mukesh Ambani.

Operating profit of digital (Jio) climbed 9% to Rs 14,644 crore due to strong revenue growth. However, Jio’s average revenue per user (ARPU) – a key metric that influences income – was at Rs 182 in Q4 FY24, up just about 2%. ARPU is the total revenue of the telecom operator divided by the number of users on its network. Launched in 2016, Jio has about 482 million customers as of March 31, 2024 and saw data and voice traffic growth of 35% and 10% on its network.

Operating profit of the retail business jumped 18% to Rs 5,829 crore, led by growth in consumer electronics and fashion & lifestyle verticals. Reliance Retail has 18,836 outlets as of March 31, 2024.

Operating profit of O2C grew marginally by about 3% to Rs 16,777 crore supported by “advantageous feedstock sourcing, ethane cracking and higher domestic product placement”, the company said.

Operating profit of oil & gas shot up by 47% to Rs 5,606 crore on account of higher volumes partly offset by lower price realization from the KG D6 Field. The media unit made an operational loss of Rs 207 crore in Q4 FY24. RIL’s net debt at the end of Q4 FY24 was Rs 1.2 lakh crore, and it had Rs 2.1 lakh crore in cash and cash equivalents.