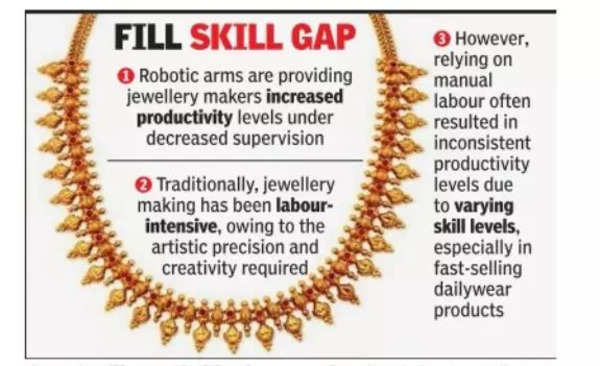

Jewellery brands like Tanishq and Malabar Gold are integrating robotic arms into their studios, harnessing the machines’ agile movement and precision. From chain-making to polishing to casting, these machines are providing jewellery makers increased productivity levels under decreased supervision.

“Most of the automation systems run in multiple shifts and require lesser maintenance.They have enhanced productivity more than two times in comparison to conventional methods,” said a Tanishq spokesperson, which introduced robots into its jewellery-making process in 2020 with a nearly Rs 5-crore investment. Currently, Tanishq’s factory in Tamil Nadu’s Hosur is equipped with three robots.

Malabar Gold and Diamonds, too, has introduced robots and automation systems in its manufacturing process, helping it eliminate manual tasks and maintain uniform quality in jewellery production. It implemented the process last year with a nearly Rs 30-crore investment.

“The automated systems are primarily used in chain-making and polishing operations. Ancillary tasks like cleaning and mould-handling have also been automated,” said M P Ahammed, chairman of Malabar Gold & Diamonds.

Jewellery making has been labour-intensive traditionally, owing to the artistic precision and creativity required for exquisite products. However, fast-selling dailywear products like plain hoops, wedding bands, diamond engagement rings and bangles have exited the realm involving manual tasks. Coins, which have emerged as a popular investment option, apart from being a convenient gifting item during festivals, too, are being made with retrofitted machines.

“Previously, relying on manual labour often resulted in inconsistent productivity levels due to varying skill levels and the inherent limitations of manual operations. However, automation has ensured error-free processes, doubling our productivity and maintaining a consistent, fine uniform quality across products,” said Ahammed.

At Tanishq, more than 150 employees work along with a team of 30-plus technology experts in the machine-made jewellery section.

The Indian jewellery sector is in for more competition with the Aditya Birla Group planning a foray into the space. It may look at automated jewellery production as well.

The Indian jewellery market is valued at Rs 8 lakh crore and is expected to grow at the rate of 5-7% annually.

Globally, too, luxury brands like Bulgari and Christian Tse have started using automation systems to make basic jewellery pieces.

While gold prices continue to be dictated upwards by global factors, production costs for jewellers switching to automation systems have resulted in costs dropping by 50% as against the conventional method.