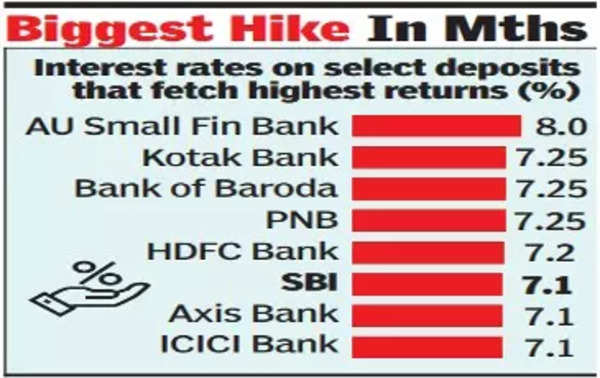

The bank’s 400-day Amrit Kalash scheme will now offer 7.1% interest (7.6% for senior citizens) and is valid till March 31, 2024. This is the second-highest return offered by a public sector bank. Bank of Baroda currently offers 7.25% on three-year deposits.

SBI has also introduced a half percentage point hike for deposits between 180 to 210 days, where rates stand revised to 5.75%. There is no revision in interest rates in the one year to less-than-three-years category as well as on deposits above five years. On all other tenures, interest rates are higher by 25 basis points. The bank offers senior citizens half a percentage point more on all deposits.

With the market leader hiking deposit rates, other banks are likely to follow suit. Liquidity in the system has been drying up with RBI continuing with its policy stance of ‘withdrawal of accommodation’.

The weighted average domestic term deposit rate of banks, which was 6.38% in March 2020 before Covid, dropped to a low 5.02% in February 2022 as the sharp rate cuts announced by RBI in the wake of the pandemic worked their way down to all deposits. Since then, the reversal of policy resulted in interest rates moving up to a high of 6.76% in October 2023.

SBI’s decision comes days before the government announces interest rates for small savings schemes such as public provident fund and post office deposits. In the last few quarters, the government has refrained from increasing rates, although pressure is building up just ahead of general elections next summer as this is likely to be the last rate setting exercise before the model code of conduct kicks in from April. Officials have argued that the interest rates on schemes such as PPF factor in the tax benefit available to individuals.