Under the subvention scheme, banks disburse the sanctioned amount directly to the accounts of builders, who are then to pay EMIs on the sanctioned loan amount until possession of the flats is handed over to the homebuyers. As builders started defaulting in paying the EMIs to the banks as per the tripartite agreement, banks initiated action against the buyers to recover the amount.

‘Banks disbursed loan to builder but didn’t link it to construction stages‘

Aggrieved by the action of banks, a large number of homebuyers had approached Delhi high court, which had in 2023 refused to grant them relief saying, there were alternate remedies available to them. Subsequently, they knocked the doors of the apex court, which granted them interim protection.

As homebuyers are facing the threat of cheque bounce cases, a bench of Justices Surya Kant and Ujjal Bhuyan on Monday directed that no cheque bounce complaint against such homebuyers be entertained while the issue is pending.

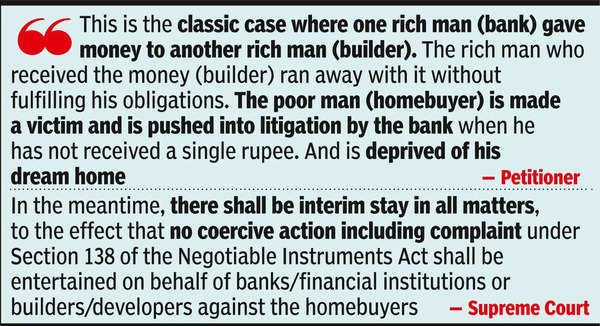

“In the meantime, there shall be interim stay in all matters, to the effect that no coercive action including complaint under Section 138 of the Negotiable Instruments Act, 1881, shall be entertained on behalf of the banks/financial institutions or builders/developers against the homebuyers,” the order, granting protection to all such homebuyers.

Challenging the HC order, the aggrieved homebuyers submitted that they were victims of illegal disbursal of loan by the bank directly into the account of the builder in violation of RBI guidelines.

“This is the classic case where one rich man (bank/financial institutions) gave money to another rich man (builder). The rich man who received the money (builder) ran away with it without fulfilling his obligations. The rich man who gave the money (bank/financial institutions), disbursed it in violation of the law of the land. The poor man (homebuyer) is now made a victim and is pushed into litigation by the bank when he has not received a single rupee. And is deprived of his dream home,” a petition, filed by advocate Anshul Gupta on behalf of a batch of homebuyers, said.

They alleged that the main violation was that the banks disbursed the loan amounts directly to the builder without linking it to the stages of construction, in gross violation of RBI circulars as well as National Housing Bank (NHB) guidelines.

“The high court failed to take note of the fact that the builder as well as bank both acted hand in glove. The poor homebuyer is used as a medium to get the loan sanctioned and money transferred from the bank to the builder. The homebuyer herein is pushed into the litigation for the amount which he himself has never seen or actually received. The acts of both builder and banks are in violation of tri-partite agreement and also in violation of RBI/NHB statutory guidelines,” the petition said.

“The homebuyers are taken for a ride and there exists no legal framework to address the issues when the insolvency proceedings are initiated against the real estate developer and banks still keep charging EMIs/pre-EMIs even when the liability of repayment is of the real estate builder,” it said.

Agreeing to examine the grievances of homebuyers, SC directed builders/developers two weeks’ time to file reply affidavit including details of their assets and the court made it clear that it would be constrained to take coercive action against them if they failed to comply with its order.