Front-running refers to an illegal practice in the stock market where an entity trades on the basis of advance information from a broker or analyst before the information has been made available to their clients.

Sebi is understood to have conducted search operations at Quant’s offices in Mumbai and Hyderabad. After reports of search operations, several stocks in the mutual fund’s portfolio ended lower on Monday. RBL Bank closed 2.6% lower while Nalco was down 2%.

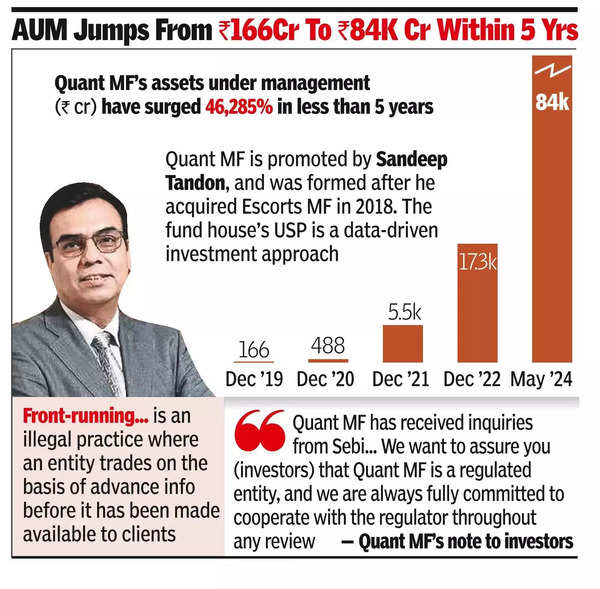

Quant MF is one of the fastest-growing mutual funds, with over Rs 84,000 crore in assets under management as of May 31. The company’s small-cap funds top the industry in performance with 31% returns in five years.

Market surveillance tools typically help detect front-running in stocks by continuously monitoring trading patterns and analysing order timing to identify suspicious activities. They compare employee trades to client orders, flagging those that consistently precede large client transactions. These tools also analyse profitability, looking for unusually high trade profits before significant market movements.

Quant MF, in a communique to shareholders, confirmed the inquiry from Sebi. “Recently, Quant MF has received inquiries from Sebi… We want to assure you that Quant MF is a regulated entity, and we are always fully committed to cooperating with the regulator throughout any review. We will provide all necessary support and continue to furnish data to Sebi on a regular and as-needed basis,” the fund house said.

Quant MF is promoted by Sandeep Tandon, and was formed after Tandon acquired Escorts Mutual Fund in 2018. The fund house’s USP is a data-driven investment approach a strategy which was borne out by the performance of its small-cap funds.

Quant claimed it currently has over 80 lakh investors and Rs 93,000 crore in assets under management. “Quant MF believes this support will continue, thanks to its research capabilities and analytical tools,” the company said.

In May 2022, Sebi directed entities involved in Axis Mutual Fund front-running case to collectively impound Rs 30 crore of wrongful gains. Sebi’s action resulted in the sacking of the mutual fund’s chief dealer.