MUMBAI: Markets regulator Sebi on Wednesday tightened rules for small and medium enterprises (SMEs) aiming to tap the public market through listing. It also tightened rules for merchant bankers, specified a time period for mutual fund managers to deploy funds raised through new fund offers (NFOs), and expanded the list of events which will be considered as price sensitive events.

It also made all Sebi regulated entities like fund houses, exchanges, depositories, custodians using artificial intelligence responsible for its fair use, including for rules that govern investor protection and usage of data.

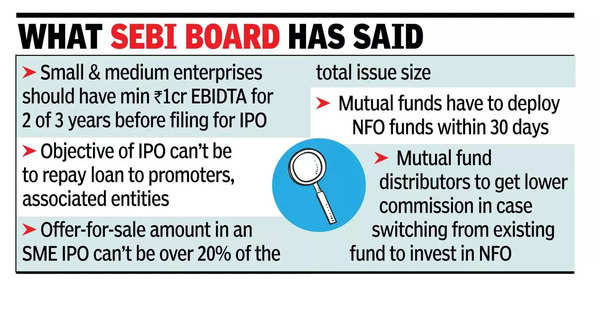

Sebi board said that an SME company can go for an IPO only if it had an operating profit (earnings before interest, depreciation and tax) of at least Rs 1 crore from operations for any two of the three previous financial years at the time of filing the prospectus for fund raising. It also said that in case of an offer for sale (OFS) in an IPO, the OFS size shall not exceed 20% of the total issue size. In addition, the selling shareholders cannot sell more than 50% of their holding through that offer.

Sebi also said that lock-in of promoters’ holding that is in excess of minimum promoter contribution (MPC) could be released only in a phased manner. The regulator has allowed 50% of promoters’ holdings in excess of MPC could be released after one year from listing and the remaining 50% could be released after two years.

Sebi also said that SME can not go for an IPO where the objects of the offer include repayment of loan to promoters, promoter group or any related party, from the issue proceeds, whether directly or indirectly. It also said IPO prospectus filed with the bourses will be available for 21 days for the public to provide comments on the same.

Last month, the regulator had issued a consultation paper on SMEs and most of its proposals from the same have now been approved by the board, a comparison of the proposed and the approved rules showed.

Sebi also changed the rules governing merchant bankers in India. It said that there would be two types of merchant bankers. Category 1 will be those with a net worth of at least Rs 50 crore who would be allowed to undertake all merchant banking activities permitted by Sebi. In addition, there would be a Category 2 merchant bankers who would be allowed to carry out all permitted activities except managing fund-raising by companies in the main boards of the bourses. These activities would include IPOs, rights offers, offers for sale (OFS), qualified institutional offers (QIPs) etc.

The regulator also said that from now on mutual fund managers will have to deploy their funds raised through NFOs within 30 days. In case they fail to do so, they will have to give exit options to all its investors to redeem their investments without any exit load.

Sebi also said that in case an investor is switching from an existing MF investment to an NFO, the distributor will get the lower of the commissions offered by the two schemes, the existing one and the NFO. This is to discourage unnecessary switching of MF investments, except for the lure of higher commission for the distributor.