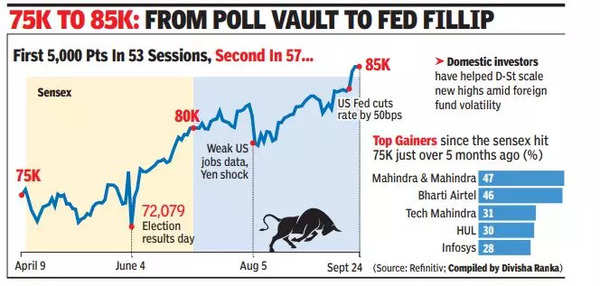

The sensex and Nifty scaled new life-highs in Tuesday’s session, with the former rallying past the 85,000 mark for the first time and the Nifty scaling the 26k peak, before both indices closed barely changed.

While the sensex ended the day at 84,914 – down 15 points – Nifty ended at 25,940, up just 1 point. Domestic funds supported the market even as foreign portfolio investors continued to sell during the day.The recent surge in benchmark indices has come on the back of the US Fed’s Sept 18 decision to cut interest rates by 50 basis points .

Sensex hits 85k for 1st time, sprints 10,000 pts in 5 months

Strong selling by foreign funds notwithstanding, the sensex and Nifty scaled new life-highs in Tuesday’s session but closed lower.

In early trades, the sensex rallied past the 85k mark for the first time while Nifty scaled the 26k peak in lacklustre trade in end-session. While the sensex closed at 84,914 – down 15 points – Nifty ended at 25,940, up just 1 point. Domestic funds supported the market even as foreign portfolio investors continued to sell during the day’s session.

This was the fifth consecutive session of gains and records for Nifty. The recent surge in benchmark indices has come on the back of the US Fed’s Sept 18 decision to aggressively cut interest rates by 50 basis points (100 basis points = 1 percentage point) in the world’s largest economy after more than four years.

“Domestic benchmarks are attempting to sustain new highs, driven by the US Fed’s aggressive rate cut. Meanwhile, the Chinese central bank’s rate cut and additional stimulus measures (this week) have positively influenced global investor sentiment, resulting in gains for domestic metal stocks,” Vinod Nair, head of research at Geojit Financial Services, said.

According to Nair, strong FPI inflows in the near term – driven by the US Fed’s dovish outlook and expectations of a rate cut by RBI in Oct – are expected to maintain momentum in the domestic market. However, some market players believe that after the sensex’s recent rally, from 80k to the 85k level in less than three months, there is strong possibility of a consolidation around current levels. Hence, the market could see some lacklustre trading sessions.

Metal stocks witnessed strong buying after China announced economic stimulus packages that are expected to revive demand for metals globally. Among the leading metal stocks, SAIL gained 3.2%, Tata Steel (4.3%), Hindalco (4%) while Vedanta closed 3.8% up. As a result, BSE’s metal index was up 2.8% – the most among all sectoral indices on the bourse.

End-of-the-session data on BSE showed that domestic funds were net buyers at Rs 3,868 crore while FPIs net sold stocks worth Rs 2,784 crore.