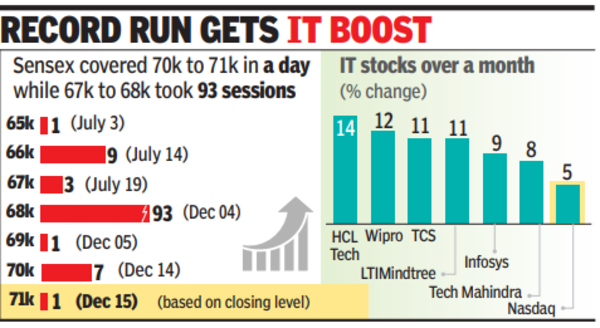

MUMBAI: The sensex capped a strong winning week with a 970-point rally on Friday to close above the 71,000-mark for the first time in history. It closed at 71,484 points as software exporters led the rally.

The US central bank‘s announcement late Wednesday that it could start cutting interest ratesin 2024 in the world’s largest market led to a global rally which continued Friday.In thedomestic market, foreign funds remained net buyers with a Rs 9,239-crore net inflow Friday that took the month’s tally to about Rs 52,000cr.

Sensex rallies close to 6k point in a month, crosses 71,000 1st time

The rally on Dalal Street continued on Friday taking the sensex beyond the 71,000- mark for the first time with software exporters leading the gains.

At close, the index was up 970 points, at 71,484 points. On the NSE, Nifty gained 274 points to 21,457, also a new all-time high for the index.

In a month, the sensex has gained 5,808 points, which is nearly 9%, a major part of which came after the BJP-led coalition won three of the four major state elections earlier this month. Falling rate of inflation, strong buying by foreign funds, a relatively stable rupee, sliding crude oil prices and robust corporate earnings by most of the large companies also helped boost investor sentiment. The latest trigger was a statement from the US central bank about the possibility of rate cuts in 2024.

According to Joseph Thomas of Emkay Wealth Management, markets on Friday moved up across sectors in response to the US Fed decision to hold rates. “Robust GDP growth numbers both in the US and in India also helped the sentiment to a significant extent. While the impact may be short-lived, the probability of profit-booking is very high as we approach the year-end. It is also likely that the talks of an impending slowdown could get more heard unlike as it was in the recent past. But equities are going to display superlative performance based on solid economic performance and gains in earnings.”

The strong rally of the previous month also added Rs 36.5 lakh crore to investors’ wealth with BSE’s market capitalisation now at Rs 364.6 lakh crore, translating to $4.4 trillion, also an all-time high level.

Unlike in the past few months, in December, foreign portfolio investors (FPIs) have again turned strong buyers in India. So far in the month, FPIs have recorded net inflows of nearly Rs 52,000 crore, data from CDSL and BSE showed. This is the highest net buying figure by FPIs since August 2022.

In Friday’s session, Infosys, TCS and RIL contributed the most to the day’s gains in sensex. On the sectoral front, the stocks of software exporters gained the most with BSE’s IT index up 4.4% on the day.