Sensex opened the session flat, dipped into negative and then recovered to start a rally that continued till the end of Thursday’s session. After scaling an all-time high at 75,500 points in intra-day trades, the index closed at 75,418, up 1,197 points, or 1.6%.

On NSE, following a similar trajectory, nifty scaled a new life-high of 22,994 points, and closed at 22,968 points, up 370 points or 1.6%.

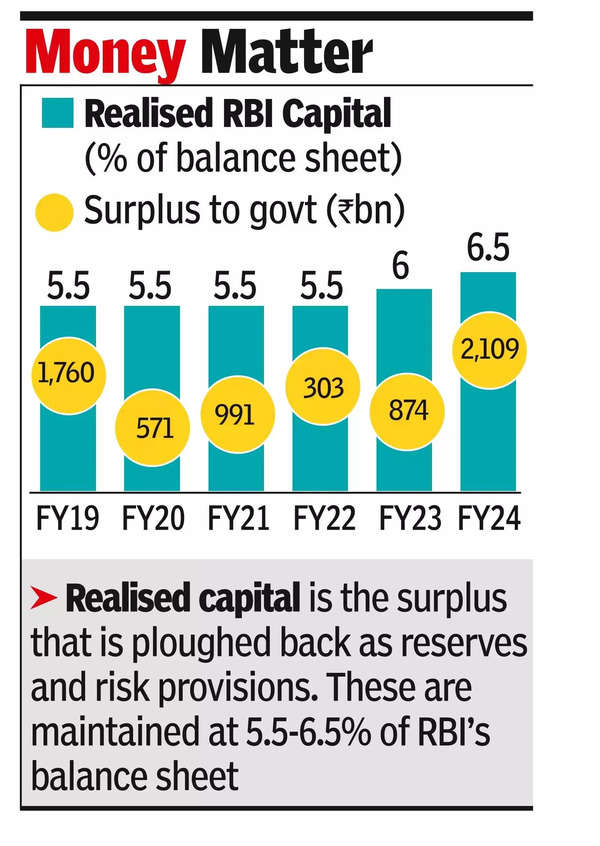

RBI dividend can help boost India’s credit rating

While RBI can create money, the dividend that it has paid to the government are out of actual earnings. A large part of this earning is higher interest income on foreign securities and profits from selling foreign exchange. The record surplus could help India improve its credit rating…

How does a regulatory and financial authority like RBI declare dividends?

RBI acts as both a regulator and a monetary authority. It manages money supply and oversees foreign exchange markets. RBI accumulates foreign currency reserves to stabilise the rupee against speculative inflows. During challenging periods like the global financial crisis or the pandemic, central banks expanded their balance sheets through quantitative easing, which involves pumping money by purchasing bonds from banks. As a result, RBI profits from interest on domestic and foreign bonds as well as market operations. In its forex operations, RBI sells dollars it purchased when there is a surge in inflows during times of scarcity. As these sales are at prevailing market prices, it makes a tidy profit.

Are profits a goal for RBI?

No. Surpluses are a byproduct of RBI working towards its objectives of financial and market stability. It is said that RBI generates more profits during difficult times because it is during crisis that central bank’s intervention in forex and money market spikes. Profit cannot be an objective for the central bank in its market operations as RBI is the biggest insider in the market.

How did it make a record profit?

Since the annual report is not published, we can only conjecture on the reasons. One could be the sharp rise in interest rates in the US where RBI parks a major chunk of its $644 billion forex reserves (Rs 54 lakh crore). Second, RBI has been buying and selling a lot more dollars this year compared to last year as FIIs have been selling equities. The third element of the earnings are RBI’s money market operations. Given that RBI has kept liquidity in a deficit mode to combat inflation, it has had many opportunities to lend to banks.

Why is this dividend good news ?

The Rs 2.1 lakh crore that govt will receive is a windfall – nearly double what was budgeted from all financial institutions put together. According to S&P, the additional amount is around 0.35% of GDP. Everything else remaining unchanged, it would reduce the fiscal deficit by that extent. S&P has said that if govt uses the money to reduce its deficit (reducing borrowing), that would increase chances of a ratings upgrade. A rating upgrade would improve India’s standing for global investors – a positive sign for markets as capital would flow in. If govt chooses to use the windfall to either stimulate the economy or provide relief to the poor, it would again be a positive as it would increase consumption.

Why are bonds rallying?

Record revenues through dividend and GST have led markets to believe that there will be a sharp drop in govt borrowing. When govt borrows less, there is more money left for corporate borrowers and interest rates dip. When interest rates dip, existing bonds that offer higher rates get sold at a premium.