MUMBAI: The return of Donald Trump to the White House could mean a mixed bag for the Indian market and the economy in the coming years.

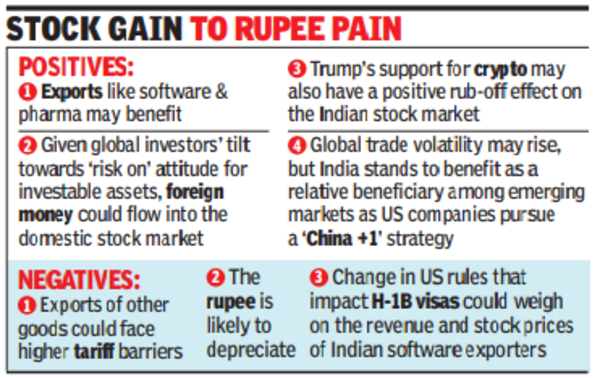

Exports from India like software services and pharma could benefit from Trump’s expected policy shift, exports of other goods could face higher tariff barriers. The Indian currency is likely to depreciate but given global investors’ tilt towards ‘risk on’ attitude for investable assets, foreign money could flow into the domestic stock market, economists, fund managers and analysts said.

“While global trade volatility may rise, India stands to benefit as a relative beneficiary among emerging markets as US companies pursue a ‘China +1’ strategy, likely boosting sectors like EMS (electronic manufacturing services), chemicals, and pharmaceuticals,” said Trideep Bhattacharya, president & CIO-Equities, Edelweiss MF.

India’s policies like ‘Make in India’, production-linked incentives (PLI), tax holidays to semiconductors, etc, would help the country under such scenarios, a report by AngelOne Wealth noted. Sectors like defensives, IT and pharma may benefit from US growth being stronger, it noted.

During the previous Trump presidency, while the sensex had nearly doubled – from about 25K to about 48K level, BSE’s IT index had more than doubled.