To be sure, govt has been unequivocal in stating that there is no proposal to introduce fees on UPI transactions. Last year, after an RBI discussion paper proposed a tiered structure charge on UPI payments, the finance ministry had clarified that there was no proposal to levy fees on UPI.

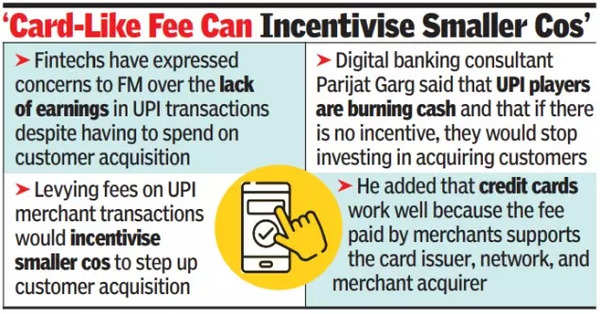

Last month, some fintech companies expressed concerns to FM Nirmala Sitharaman about the lack of earnings in UPI despite having to spend on customer acquisition. They also raised similar issues in a recent virtual meeting with NPCI.

“Zero MDR (merchant discount rate) eating up business models was a point raised in the meeting with FM,” said a fintech executive who attended the meeting.

“Some of us discussed issues related to UPI transactions made via prepaid payment instruments with NPCI although there has been no conclusive outcome,” said another fintech executive. NPCI declined to comment.

Walmart-owned PhonePe and Google Pay dominate 80% of UPI market, posing risk. RBI’s restrictions on Paytm lead to its UPI transactions decreasing from 1.4 billion to 1.3 billion in February..

One of the reasons for the regulator allowing the shift of the @paytm UPI handle from Paytm Payments Bank to its parent company was to ensure that the lead players shares do not rise further.

Levying fees on UPI merchant transactions will incentivise smaller players to accelerate customer acquisition, said digital banking consultant Parijat Garg. “All UPI players are burning cash. If there is no incentive, why would they invest in acquiring customers? Credit cards work well because the MDR paid by merchants supports the card issuer, network, and merchant acquirer. UPI as a system has to self-sustain itself in the long term, so there have to be some inherent revenue models,” said Garg. Besides, it will also attract bigger platforms with large transaction volumes to enter the space. “Once MDR is levied, there will be a battle for customer acquisition, boosting the ecosystem,” said Satish Meena, advisor at market research firm Datum Intelligence.