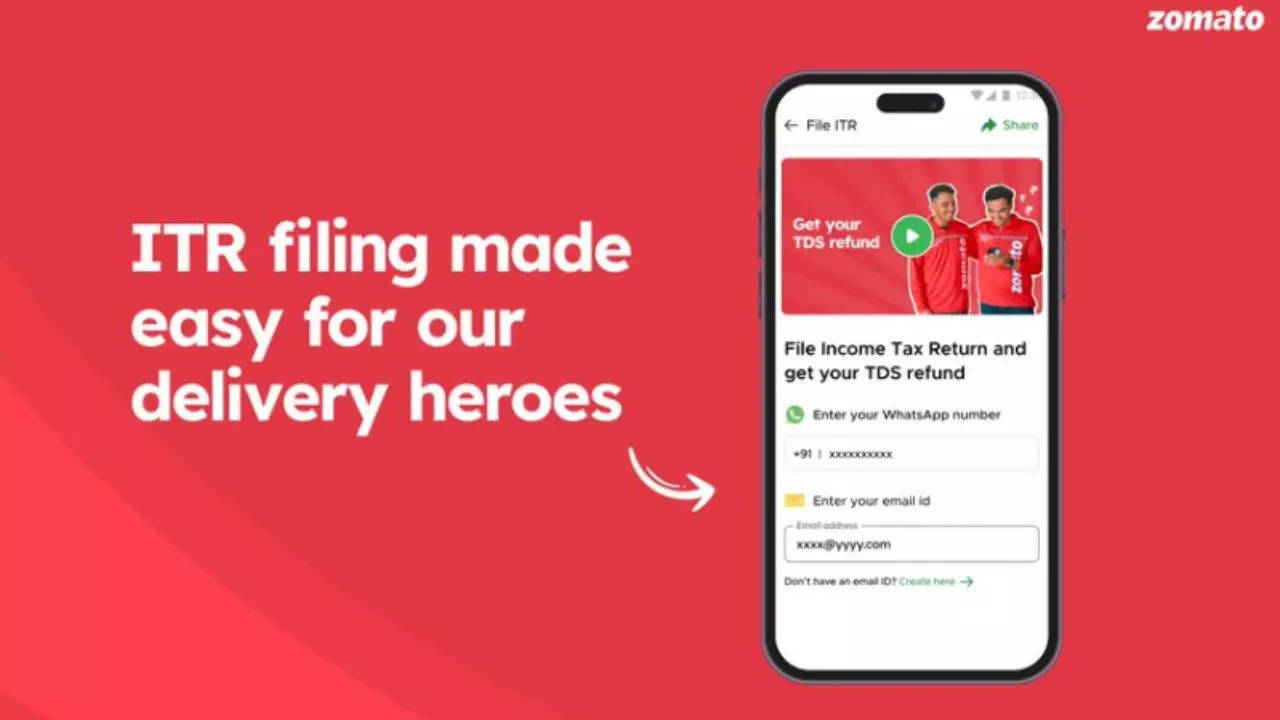

Overwhelming response from delivery partners

According to an ET report, Zomato co-founder and CEO, Deepinder Goyal, announced in a recent post on X that within just 48 hours of the feature going live on the Zomato Delivery Partner app, over 100,000 partners had already initiated their ITR filing.This enthusiastic response highlights the demand for streamlined tax processes among delivery personnel.

Significant tax refunds expected

Goyal disclosed that Zomato expects its delivery partners to collectively receive tax refunds exceeding Rs 40 crore. This substantial amount reflects the scale of operations and the impact of the initiative on the financial well-being of the partners.

Zomato’s financial contributions to delivery partners

The Gurgaon-based company reported that it disbursed over Rs 4,000 crore to its delivery partners last year. As mandated by the government, Zomato deducts 1% TDS from these payouts. The new initiative aims to facilitate the tax filing process for many delivery partners, who will be filing taxes for the first time.

Long-term benefits for delivery partners

Goyal emphasised the broader advantages of this initiative, stating, “Most of our delivery partners will be filing taxes for the first time, which should make their lives easier in the long run. For example, they will be able to get access to structured credit, qualify for scholarships for their kids at various educational institutions, etc.”

Delivery partners’ engagement and Zomato’s financial performance

According to Zomato’s latest shareholder letter, the company had an average of 418,000 monthly active delivery partners in the last quarter of FY24. This engagement is critical to the company’s operations and financial health.

Zomato reported its fourth consecutive quarter of net profit, with Rs 175 crore for the January-March period, a significant improvement from a loss of Rs 188 crore in the same period the previous year. Operating revenue saw a 73% year-on-year growth, reaching Rs 3,526 crore for the quarter.

Ongoing tax challenges

Despite these positive developments, Zomato continues to face tax-related challenges. On June 30, ET reported that Zomato received a tax demand totaling Rs 9.5 crore from the Karnataka commercial tax authority, including interest and penalties. This is not an isolated incident, as Zomato has faced similar demands in the past, including a Rs 11.82 crore demand on April 20 for export services provided to its subsidiaries outside India, and a Rs 23 crore demand on April 1 for availing an excess input tax credit from the Karnataka commercial taxes authority.

Additionally, on March 15, Gujarat’s deputy commissioner of state tax raised a demand for Rs 8.6 crore on the company. These challenges underscore the complex regulatory environment in which Zomato operates.

Also read | Reliance Jio brings back Rs 999 prepaid plan: Unlimited 5G and extended validity