An Aussie landlord has been blasted by fellow investors after he asked for advice on whether his tenant was responsible for replacing a broken shower head.

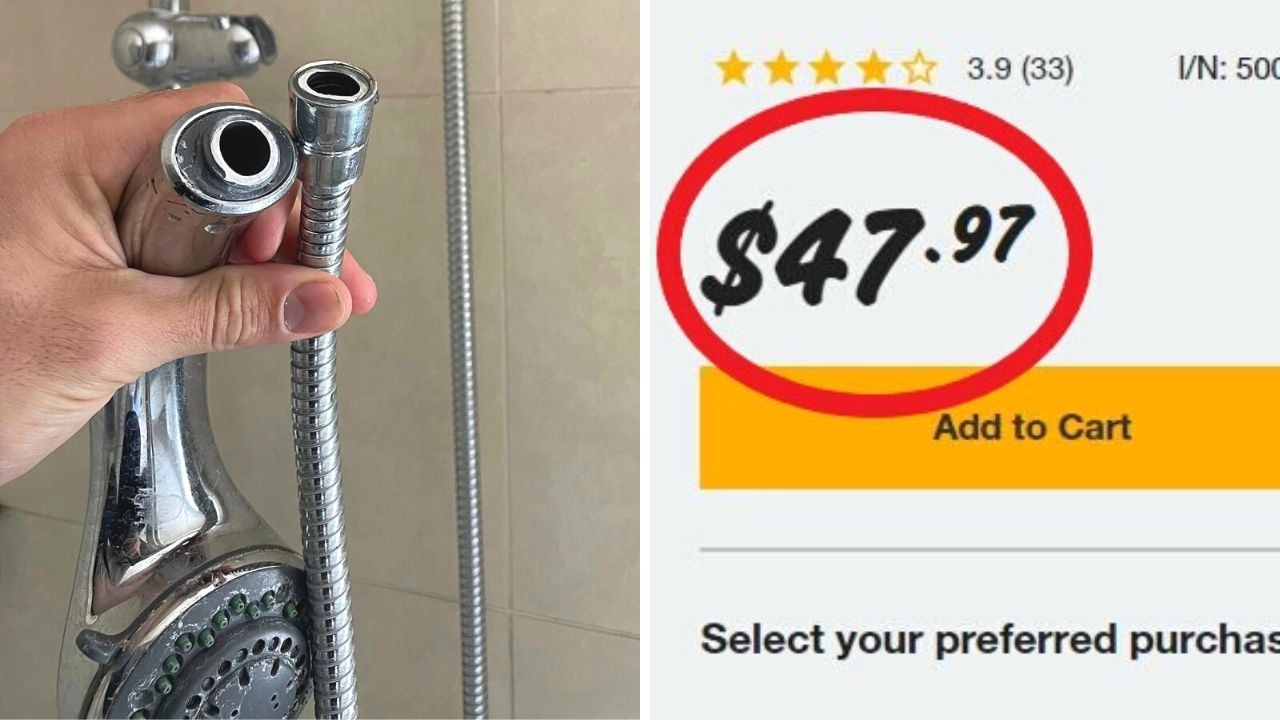

The homeowner posted in a private landlord group with a photo of the broken fitting asking whether the cost of fixing it was his or his tenant’s responsibility, noting that the break “happened while the tenant [was] showering”.

Dozens of other group members flooded to the post, with many shocked the landlord would even have to ask such a question.

“You’re not serious are you? Buy a new shower head,” one person wrote.

“Please tell me you’re not serious. Tenants are not responsible for replacing or repairing fixed items,” another said.

“Oh come on, this is a joke,” one added, with someone else asking, “Why is this even a question?”

Every group member that commented on the post was in agreement that the replacement of the shower head was the landlord’s responsibility, but that didn’t stop people from piling on the poster over the question.

One person claimed it was posts like this that give “good landlords a bad name”, claiming they should already know their responsibilities.

Others lashed out at the property owner for buying “cheap” fittings, noting they shouldn’t be surprised when they break.

One group member shared a link to what appeared to be the same or a very similar product, noting it would cost the landlord less than $50 to replace.

“Uhm look at the general wear of the shower head … obviously put in a cheap ass shower head and now trying to see if you can get the tenants to replace it. Surely you’re not serious?” one person said.

Another joked: “Landlord hack, buy cheap finishings that break super easy, then charge tenants to replace for better!”

Other property investors suggested getting “top quality” fittings with good warranty, noting it will work out cheaper for the landlord in the long term when they aren’t having to continually be fitting replacements.

Other commenters suggested the owner just sell their house if they have to question whether they should spend less than $50 to fix an item in their property.

This is not the first time a property investor has been taken down a peg when asking for advice from their fellow landlords.

Recently, a woman was told to “suck it up” after complaining she was being left “out of pocket” despite raising the rent to the “higher end” of the current market value.

She took to the Landlord Facebook group to ask what factors people take into consideration when pricing their rent and how much money each week they are personally having to put into their investment.

She claimed that when setting her weekly rent rate she factors in her mortgage repayments, property management fees, council rates, water rates, insurance and maintenance.

“Even at the higher end of the current market value, we’re still out of pocket $150 per week, and I’m curious if this is the norm for a lot of landlords with residential properties,” she asked.

The post garnered dozens of comments from other landlords, but it turns out there were many who weren’t impressed with her approach to owning a rental property.

Many people were quick to point out the only factor that should be determining her rental return is the current market rate, with the rest being expenses that she personally needs to manage – not the tenant.

“The only determinant of rent is the market, and the supply and demand of that market. The rent is completely independent and separate from your holding costs,” one person said.

“Market forces are what determine your rent. The reality of an investment is you do have to absorb some of the cost, if you can’t afford it sell it, it’s a harsh reality check but it’s just the way it is,” another wrote.

Others said her costs were “irrelevant” to how much rent she should be getting.

“I don’t know anyone with a recent mortgage on an IP who isn’t negatively geared if bought in a decent city,” they said.

“Your investment is about how much the property will be worth in the future, not about the current rental yield (although it has to be taken into account). Sorry but your way of thinking is pre-2000s.”

It comes as the burden on Aussie renters continues to grow due to the worsening rental crisis, with new data revealing they are paying on average a house deposit every five years in rent.

The research from the Parliamentary Library, commissioned by the Greens, compiled Australian Bureau of Statistics data and estimated the average renter had paid $106,550 per household over the period.

Over 10 years, the data indicated a household had paid $209,908 in rent.

But the library warned the data relied on a number of very broad assumptions, including an average rent of $401 per week paid.

“They do not reflect any particular individual circumstances,” it said.

Greens housing spokesman Max Chandler-Mather said for many, the cost of rent made it “impossible” to save for a deposit.

“Banks won’t give you a mortgage without a deposit, even though as this data shows, renters are already paying almost a housing deposit worth of rent every five years,” he said.

“In effect, renters end up paying off someone else’s mortgage while often copping massive rent increases that make it impossible to save for a house themselves.”

– with NCA NewsWire