MUMBAI:

A strong stock market, that is offering good valuation and pricing, is prompting promoters and private equity players to take companies public, with the number of initial public offerings (IPOs) reaching a multi-year high. And, the bullish trend in the primary market is likely to continue for at least a few more months, merchant bankers said.

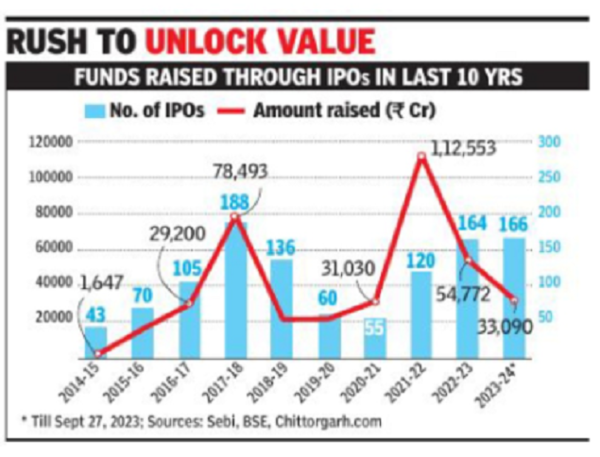

Consider this: So far in the current fiscal, 166 companies have gone public through IPOs, compared to 164 in the previous full year. In the last 10 years, the highest such new public offerings were in 2017-18 when 188 companies had gone public, data showed. These numbers include large companies, which list on the main board of the bourses, and SMEs.

In terms of money raised, however, the Rs 30,090 crore raised is about a quarter of Rs 1.1 lakh crore raised in 2021-22 when large offers, such as, from PayTM, Zomato, Star Health and Nykaa had hit the market.

Better pricing, positive market sentiments and a robust outlook have been the reasons for buoyancy in the IPO market, according to S Ramesh, MD & CEO, Kotak Investment Banking. “Listing gain (basis closing price on Day 1 vis-a-vis IPO price) in FY24 is 34% as against 9% in FY23 for IPOs greater than Rs 250 crore. Retail subscription numbers have also improved in FY24 as overall markets have fared better than FY23,” Ramesh said. “Average retail subscriptions in IPOs greater than Rs 250 crore in FY24 YTD was 16.4 times as against 6.9 times in FY23.”

In comparison to the current year, FY23 had seen a bit of a downturn as LIC, the largest IPO in the country’s history, failed to meet investors’ expectation. Launched in May 2022 at Rs 940 per share, the stock closed lower on the listing day and is still under the water by about 31%, at Rs 648 now. However, in the last six months things have turned around for the better.

“Capital raising through IPOs this year have been fairly broad-based,” said Nipun Goel, head, investment banking, IIFL.

The good times are expected to last for a few months for sure, top merchant bankers said. “The IPO market is building momentum and we may see a longer window. Also, investors prefer to invest in companies that they are holding and tracking for a long period. The participation indicates the great breadth and depth of the market. Foreign investors have also been turning confident once again in India’s long-term growth story ,” Ramesh said.