Reserve Bank of India has decided to keep the repo rate unchanged at 6.5%: Shaktikanta Das

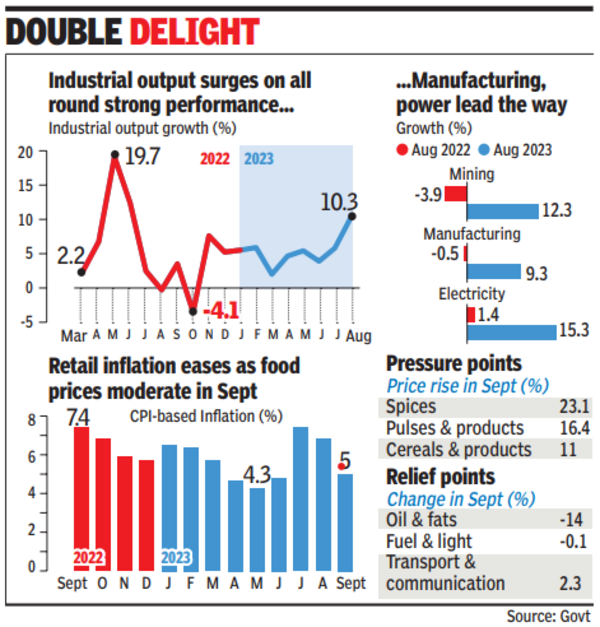

Data released by the National Statistical Office (NSO) on Thursday showed retailinflation, as measured by the Consumer Price Index (CPI), rose an annual 5% in September, slower than the 6.8% in August and below the Reserve Bank of India’s (RBI’s) upper tolerance band of 6%.The food price index slowed to 6.6% from nearly 10% in the previous month. Rural inflation was at 5.3% while urban was lower at 4.7%. Moderation in prices was largely led by an easing of vegetable and cooking gas prices.

Finance minister Nirmala Sitharaman said the government has already taken pre-emptive measures to restrain food inflation, which is likely to subside price pressures in the market soon.

RBI governor Shaktikanta Das said the September retail inflation data was in line with the central bank’s internal assessment and said the sharp spike in the past was a temporary phenomenon.

“But due to active cooperation, we knew it was a temporary spike and it would moderate in two months. We did not do a knee-jerk reaction and continued with the pause. But we were directly engaged with the government, which undertook certain measures (to cool down prices). Effective coordination, RBI communication on interest rates and on inflation, have all worked together. It is entirely in line with our projections. Q2: 6.4.. The internal number for September is also 5%,” Das told reporters in Marrakech.

Economists said the RBI is expected to continue with its pause on interest rates and the rate easing cycle may commence only in the second quarter of fiscal year 2025 but cautioned that the Israel-Hamas conflict and its impact on oil prices need to be watched.

Separate data released by the NSO showed the Index of Industrial Production (IIP) rose 10.3% in August, led by an all-round strong performance by manufacturing, mining, and electricity sectors. The data showed the capital goods sector, a key gauge of investment activity, grew by 12.6% in August compared to 4.3% in August 2022. The infrastructure and construction sector rose 14.9% in August.